Loading

Get Vat769

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat769 online

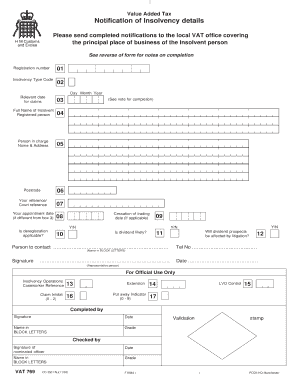

The Vat769 form is essential for notifying the relevant VAT office about insolvency details. This guide provides clear, step-by-step instructions on how to fill out the Vat769 online, ensuring you complete it accurately and efficiently.

Follow the steps to complete the Vat769 form online.

- Click 'Get Form' button to access the Vat769 form and open it in your preferred document editor.

- Begin with box 1: Enter the registration number of the individual or entity undergoing insolvency.

- For box 2, select the relevant insolvency type code. Choose from bankruptcy, compulsory winding up, creditors voluntary winding up, members voluntary winding up, deed/scheme or voluntary arrangement, administrative receivership, or administration order.

- In box 3, provide the relevant date for claims, as defined under Section 387 of the Insolvency Act 1986.

- Complete box 4 with the full name of the insolvent registered person.

- For box 5, enter the name and address of the managing practitioner responsible for correspondence.

- In box 6, fill in the postcode associated with the managing practitioner's address.

- Provide your reference or court reference in box 7, ensuring to quote it correctly for any further correspondence.

- If applicable, fill box 8 with your appointment date, noting if it differs from the date provided in box 3.

- Answer yes or no to box 9 regarding the cessation of trading date.

- Indicate in box 10 whether deregistration is applicable by answering yes or no.

- In box 11, specify if a dividend is likely to be paid out by answering yes or no.

- For box 12, clarify if the prospects for dividends will be impacted by any ongoing litigation, responding with yes or no.

- Add the contact person's details and telephone number as required in the subsequent fields.

- Sign and date the form, ensuring your name is clearly written in block letters.

- Finally, review all entries for accuracy. Save changes, and you may choose to download, print, or share the completed Vat769 form as needed.

Complete your VAT documents online today to ensure compliance and accurate submissions.

A liquidator's expenses are allowable in computing profits for tax purposes where they would be deductable under the normal taxation principles. The liquidator of the company is its "proper officer" within the Taxes Management Act 1970 section 108(1) .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.