Loading

Get St 105 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 105 Form online

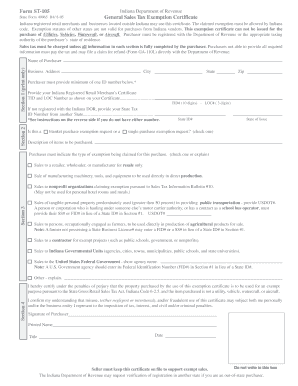

The St 105 Form is a General Sales Tax Exemption Certificate for use by Indiana registered retail merchants and businesses located outside Indiana. This guide provides comprehensive instructions on how to accurately complete the form online, ensuring that all required information is submitted correctly.

Follow the steps to fill out the St 105 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out Section 1. Enter the name of the purchaser, business address, city, state, and zip code. Make sure to provide at least one ID number from the options provided.

- Indicate whether the exemption request is for a blanket purchase or a single purchase by checking the appropriate box.

- Describe the items to be purchased. Specify the type of exemption being claimed by checking the relevant box or providing an explanation.

- Proceed to Section 3. Check the reason for the exemption. Ensure that you provide additional details if required based on the type of exemption chosen.

- Complete Section 4 by signing the form, entering the printed name and title of the signer, and the date of completion.

- Once all sections of the form are fully completed, review the information for accuracy. You can then save your changes, download, print or share the form as necessary.

Get started on completing your St 105 Form online today.

An Indiana resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.