Loading

Get 401(k) Contribution Remittance Form - Fidelity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 401(k) Contribution Remittance Form - Fidelity online

Filling out the 401(k) Contribution Remittance Form for Fidelity is an essential step for managing your contributions effectively. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

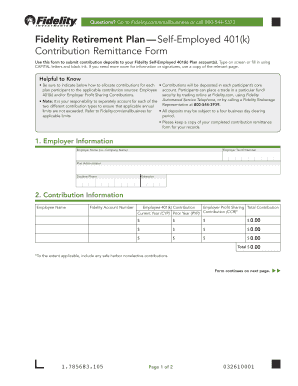

- Begin with the Employer Information section. You will need to provide details such as the employer name (company name), employer tax ID number, the plan administrator's name, and a daytime phone number, including any necessary extension.

- In the Contribution Information section, enter the employee name and Fidelity account number. Then, provide the current year contribution and prior year contribution amounts for both Employee 401(k) contributions and Employer Profit Sharing. Ensure that you specify all contributions accurately and total them correctly.

- Proceed to the Authorization section. Here, print the name of the plan administrator or employer and the date. Carefully read the conditions outlined, as you will be agreeing to them with your signature, confirming your understanding of compliance with contributions limits and the responsibility of proper allocation.

- Sign the form in the designated section. Ensure that your signature is clear, as this authorizes Fidelity to process your contributions. Remember to make checks payable to Fidelity Investments, including your account number on the memo line.

- Finally, keep a copy of your completed contribution remittance form for your records. You can then save changes, download, print, or share the form as required.

Take action now and complete your 401(k) Contribution Remittance Form online.

With IRA Financial Group's Self-Directed Solo 401(k) Plan at Fidelity, you will be able to make traditional investments, such as stocks, as well as alternative asset investments, such as real estate, precious metals, hard money loans, tax liens, private business investments, and much more and incur NO custodian fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.