Loading

Get Hotel Tax Exempt Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hotel Tax Exempt Form online

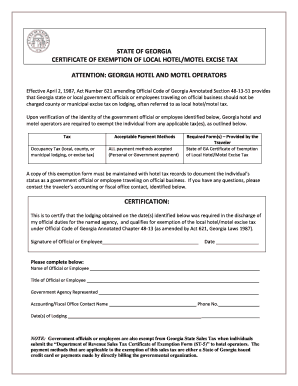

Filling out the Hotel Tax Exempt Form online is a straightforward process designed to ensure government officials and employees can receive exemptions from local hotel or motel excise tax while traveling for official business. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Hotel Tax Exempt Form easily.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by completing the certification section, where you will certify that the lodging was required for your official duties. Sign and date the form in the designated areas.

- Fill in your name, title, and the name of the government agency you represent in the appropriate fields.

- Provide the contact information for your accounting or fiscal office by entering the contact name and phone number.

- Indicate the dates of lodging in the specified section, ensuring accuracy to confirm the business nature of the stay.

- Review all filled fields to ensure the accuracy and completeness of the information you provided.

- Once all information is confirmed, save your changes to the form. Proceed to download, print, or share the completed form with the relevant parties.

Complete your Hotel Tax Exempt Form online to ensure your exemption is processed smoothly.

Related links form

Accommodations paid for with IBA cards are only exempt from state taxes in the following states: Delaware, Florida, Kansas, Louisiana, Massachusetts, New York, Oregon, Pennsylvania, Texas, Washington, and Wisconsin.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.