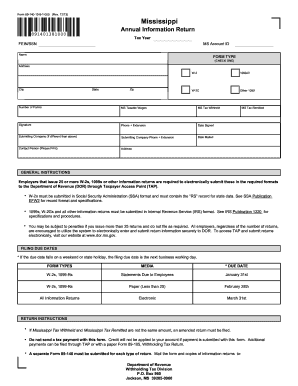

Get Form 89 140

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Taxable online

How to fill out and sign IRS online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Have you been trying to find a quick and practical solution to fill out Form 89 140 at a reasonable price? Our platform gives you an extensive selection of forms that are available for filling out online. It only takes a couple of minutes.

Keep to these simple instructions to get Form 89 140 ready for sending:

- Choose the document you want in the collection of legal forms.

- Open the template in the online editor.

- Read the recommendations to learn which data you will need to provide.

- Select the fillable fields and put the necessary information.

- Put the relevant date and place your electronic signature when you fill in all other fields.

- Look at the completed form for misprints along with other errors. If there?s a need to change something, our online editor along with its wide variety of tools are ready for your use.

- Download the filled out template to your device by clicking Done.

- Send the electronic document to the parties involved.

Filling out Form 89 140 doesn?t need to be complicated any longer. From now on easily get through it from your apartment or at the place of work right from your mobile or desktop.

How to edit Amended: customize forms online

Fill out and sign your Amended quickly and error-free. Get and edit, and sign customizable form templates in a comfort of a single tab.

Your document workflow can be a lot more efficient if everything you need for editing and handling the flow is organized in one place. If you are searching for a Amended form sample, this is a place to get it and fill it out without searching for third-party solutions. With this intelligent search engine and editing tool, you won’t need to look any further.

Just type the name of the Amended or any other form and find the right sample. If the sample seems relevant, you can start editing it right on the spot by clicking Get form. No need to print or even download it. Hover and click on the interactive fillable fields to place your information and sign the form in a single editor.

Use more editing tools to customize your form:

- Check interactive checkboxes in forms by clicking on them. Check other parts of the Amended form text with the help of the Cross, Check, and Circle tools

- If you need to insert more textual content into the file, use the Text tool or add fillable fields with the respective button. You can also specify the content of each fillable field.

- Add pictures to forms with the Image button. Upload pictures from your device or capture them with your computer camera.

- Add custom visual components to the document. Use Draw, Line, and Arrow tools to draw on the document.

- Draw over the text in the document if you wish to hide it or stress it. Cover text fragments using theErase and Highlight, or Blackout tool.

- Add custom components like Initials or Date using the respective tools. They will be generated automatically.

- Save the form on your computer or convert its format to the one you require.

When equipped with a smart forms catalog and a powerful document editing solution, working with documentation is easier. Find the form look for, fill it out instantly, and sign it on the spot without downloading it. Get your paperwork routine simplified with a solution tailored for editing forms.

The due date for filing 2022 Mississippi Individual Income Tax Returns is April 18, 2023. Anyone that requests an extension of time to file has until October 15, 2023 to file the return. Please note that the extension of time is for filing the return, not paying the tax.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.