Loading

Get Publication 596 Worksheet 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Publication 596 Worksheet 1 online

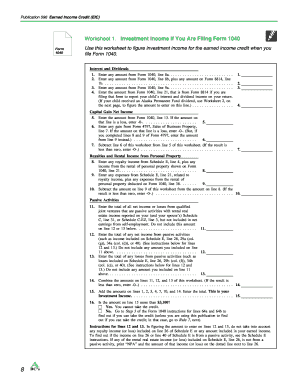

The Publication 596 Worksheet 1 is a critical document for calculating investment income when applying for the earned income credit. This guide provides clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to fill out your Publication 596 Worksheet 1 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by entering any amount from Form 1040, line 8a in the first designated space for interest and dividends.

- In the second line, enter the total of amounts from Form 1040, line 8b, plus any amount on Form 8814, line 1b.

- Proceed to line 3 and input the amount from Form 1040, line 9a.

- For line 4, if applicable, enter the amount from Form 1040, line 21, specifically that sourced from Form 8814.

- Move on to the capital gain net income section. For line 5, enter the amount from Form 1040, line 13; if it shows a loss, input -0-.

- On line 6, enter any gains from Form 4797, Sales of Business Property, line 7. If this amount is a loss, enter -0-.

- In line 7, subtract line 6 from line 5. If the result is negative, enter -0-.

- Continue to royalties and rental income. For line 8, enter any royalty income from Schedule E, line 4, plus rental income shown on Form 1040, line 21.

- For line 9, enter any expenses from Schedule E, line 21 related to royalty income, including those deducted on Form 1040, line 36.

- Line 10 requires you to subtract line 9 from line 8. Enter -0- for negative results.

- Next, for passive activities, line 11 needs the total of net income or losses from qualified joint ventures related to rental real estate income from your (and your partner’s) Schedule C, line 31.

- On line 12, enter net income from passive activities, ensuring it doesn’t include amounts from line 11.

- For line 13, if there are losses from passive activities, include the total without amounts included on line 11.

- Combine the amounts from lines 11, 12, and 13 for line 14, and enter -0- for negative results.

- In line 15, add amounts from lines 1, 2, 3, 4, 7, 10, and 14. This total is your investment income.

- Finally, check line 15. If it exceeds $3,100, note that you cannot take the credit. If not, proceed to Step 3 of the Form 1040 instructions.

- Once you have completed all steps, save your changes, download, print, or share the form as necessary.

Complete your Publication 596 Worksheet 1 online today to ensure your earned income credit application is accurate.

You must have earned income to meet the qualifications for the Earned Income Credit. Unearned income (interest, sale of investments, pensions, and unemployment) doesn't qualify. If you're a military taxpayer with nontaxable combat pay, you can include the combat pay in income to calculate the EIC .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.