Loading

Get Form Vat 112 Application Notifying Changes In V At Registra ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

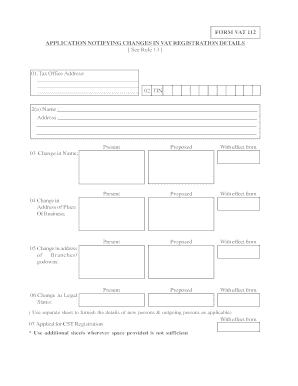

How to fill out the FORM VAT 112 APPLICATION NOTIFYING CHANGES IN VAT REGISTRATION DETAILS online

Filling out the Form VAT 112 is essential for notifying relevant authorities about changes in your VAT registration details. This guide will help you navigate through each section of the form with clear and concise instructions.

Follow the steps to complete your application accurately.

- Press the ‘Get Form’ button to access the form online and open it in your preferred editing tool.

- In the first section, provide the tax office address. Fill in the address fields completely to ensure proper communication regarding your application.

- Enter your Tax Identification Number (TIN) in the designated space to uniquely identify your business.

- Complete the name and address fields under present and proposed sections as required. Indicate when the proposed changes will take effect.

- If you are notifying a change in your business name, address, or legal status, ensure to specify the current and proposed information clearly.

- If applicable, provide details about branches or warehouses that have changed addresses.

- Clearly outline any changes in your business activities and list the principal commodities you are currently trading.

- If you have commenced or stopped executing work contracts for state government or local authorities, fill in the relevant dates.

- Provide your new bank account details, including the bank name, branch name, and account number.

- Complete the declaration section by entering your name, title, the date, and adding your signature and stamp to confirm the accuracy of the information provided.

- Once all sections are completed, review your form to ensure accuracy before saving the changes.

- You can then download, print, or share the form as needed for submission.

Start completing your Form VAT 112 online today to keep your VAT registration details up to date.

Adjustment of MVAT payable, if any as per Return Form 234 against the excess credit as per Form 231.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.