Loading

Get Ded 941 Tif

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ded 941 Tif online

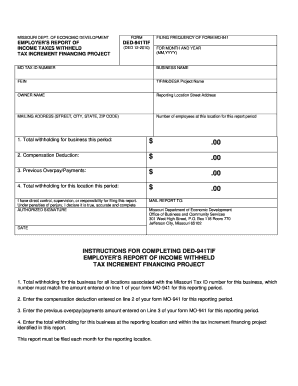

The Ded 941 Tif is an essential document for employers involved in tax increment financing projects in Missouri. This guide provides clear and supportive instructions on how to complete the form efficiently online.

Follow the steps to complete the Ded 941 Tif online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the reporting month and year in the format MM,YYYY at the top section of the form.

- Provide your Missouri tax ID number in the designated field, ensuring it matches the MO-941 form.

- Fill in your business name and Federal Employer Identification Number (FEIN).

- Specify the TIF/MoDESA project name related to your report in the corresponding field.

- Complete the owner name and input the reporting location street address.

- Input the mailing address, including street, city, state, and zip code, for correspondence.

- Indicate the number of employees at this location for the reporting period.

- Report the total withholding for your business this period in the allocated field.

- Enter the compensation deduction for the period as derived from your previous filings.

- Record any previous overpayment or payments made in the relevant field.

- Calculate and fill in the total withholding for this location during the reporting period.

- Confirm your direct control, supervision, or responsibility for filing this report and sign in the authorized signature section.

- Finally, save your changes, download, print, or share the form as needed.

Complete your Ded 941 Tif form online today for accurate and timely reporting.

Move a page break On the View menu, click Normal. Rest the pointer on the page break line until the pointer changes to a. , and then drag the page break line to a new location. Note: When you move an automatic page break, it changes to a manual page break. Manual page breaks are not adjusted automatically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.