Loading

Get Arizona Form 202

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form 202 online

Filling out the Arizona Form 202 online can seem overwhelming, but with the right guidance, the process can be straightforward and efficient. This guide will walk you through each step of the process to ensure you complete the form accurately and successfully.

Follow the steps to complete the Arizona Form 202 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

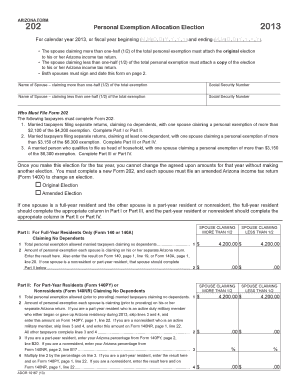

- Identify the section relevant to your situation: spouses filing separately claiming no dependents or those claiming dependents. Each section has specific instructions and requirements.

- Fill out the names and Social Security numbers for both spouses, indicating who is claiming more than one-half of the total personal exemption.

- Depending on your filing status, complete either Part I or II for full-year residents, or Part III or IV for part-year residents or nonresidents.

- For each part, accurately enter the total personal exemption amounts and the individual claims for both spouses as instructed in the fields provided.

- Ensure both spouses sign and date the form on the appropriate lines to validate the agreement on the claimed exemptions.

- After completing the form, save your changes. You may also download, print, or share the completed form as needed.

Complete the Arizona Form 202 online today to ensure your personal exemptions are accurately claimed.

Nonresident individuals must file income tax returns in both Arizona and their home state. Although it may appear as though a nonresident taxpayer is paying taxes twice on the same income because of reporting requirements, credits allowed offset that income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.