Loading

Get Simple Ira Form 5304 - Oppenheimer Funds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SIMPLE IRA Form 5304 - Oppenheimer Funds online

This guide will provide clear and detailed instructions on how to fill out the SIMPLE IRA Form 5304 for Oppenheimer Funds online. Whether you are familiar with digital document management or new to the process, this comprehensive guide aims to make filling out the form straightforward and user-friendly.

Follow the steps to successfully complete your SIMPLE IRA Form 5304.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

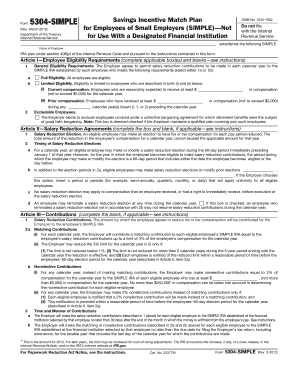

- Begin by completing Article I regarding employee eligibility. Select either 'Full Eligibility' or 'Limited Eligibility' by checking the appropriate box. If choosing 'Limited Eligibility', fill in the required compensation amounts and prior compensation years.

- Proceed to Article II to establish salary reduction agreements. Indicate the salary reduction elections and ensure to clarify the timing options for making modifications or terminations of contributions.

- Complete Article III on contributions. Specify the matching contributions or nonelective contributions that will be made to the employee's SIMPLE IRA, including any required thresholds for eligibility.

- In Article IV, review the terms related to contributions, vesting requirements, and restrictions on withdrawals to ensure compliance with IRS regulations.

- Finalize the form by confirming the effective date in Article VII. Ensure that all sections are appropriately signed and dated.

- After filling out the form, you can save changes, download, print, or share it as necessary to maintain your records.

Start filling out your SIMPLE IRA Form 5304 online today to ensure you meet all eligibility and contribution requirements!

Related links form

SIMPLE IRA contributions are not subject to federal income tax withholding. However, salary reduction contributions are subject to social security, Medicare, and federal unemployment (FUTA) taxes. Matching and nonelective contributions are not subject to these taxes. Reporting employer deductions of contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.