Loading

Get Income-driven Repayment Plan Request - Nelnet Loan Servicing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Income-driven Repayment Plan Request - Nelnet Loan Servicing online

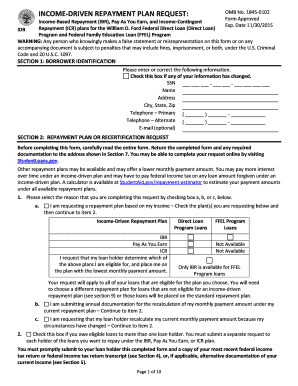

This guide provides step-by-step instructions on completing the Income-driven Repayment Plan Request for Nelnet Loan Servicing online. Users seeking to adjust their student loan repayment plans based on income will find this resource valuable and easy to follow.

Follow the steps to successfully complete your online form.

- Press the ‘Get Form’ button to access the Income-driven Repayment Plan Request and open it in the editor.

- Begin with Section 1: Borrower Identification. Here, enter or correct your personal information, including your Social Security Number, name, address, and phone numbers. Ensure accuracy when filling out these fields.

- In Section 2: Repayment Plan or Recertification Request, select the reason for your request by checking the appropriate box. If you are applying based on your income, indicate which specific plan you are requesting.

- Proceed to Section 3: Spousal Information if applicable. Complete this section if you file a joint tax return or if your spouse has eligible loans. Fill out the necessary fields accurately.

- Section 4: Family Size and Federal Tax Information requires entering your family size and determining if your income differs from your tax return. Answer these questions truthfully based on your current situation.

- If necessary, move to Section 5: Alternative Documentation of Income. Here, provide details about your income sources if your situation has changed significantly.

- In Section 6: Borrower Request Understandings, Authorization, and Certification, read the statements carefully and sign to certify that the information provided is accurate.

- Section 7 indicates where to send your completed request. Ensure you send the form and any necessary documents to the correct address.

- After filling out all sections, verify your entries for accuracy. Then, you can save the changes, download, print, or share the completed form as needed.

Take control of your loan repayment by completing the Income-driven Repayment Plan Request online today.

You can get PSLF only if you enroll in and make payments under one of the income-driven repayment plans. While payments made under the 10-Year Standard Repayment Plan also qualify for PSLF, you will have fully paid off your loan within 10 years (i.e., before you can qualify for forgiveness) if you pay under that plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.