Loading

Get Incometaxreturnverificationform

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Incometaxreturnverificationform online

Completing the Incometaxreturnverificationform online is an essential step in ensuring your income tax return is validated. This guide provides clear, step-by-step instructions to help users accurately fill out their form with confidence.

Follow the steps to complete the Incometaxreturnverificationform online.

- Press the ‘Get Form’ button to obtain the Incometaxreturnverificationform and open it in a suitable editor.

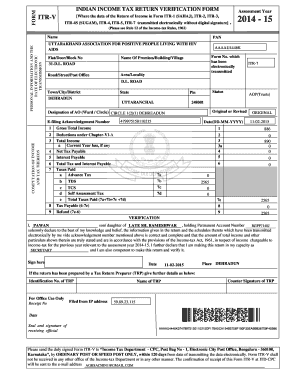

- Read the assessment year section at the top of the form, which indicates the financial year for which you are filing the return.

- Enter your name in the designated field. Ensure that your name matches the official documents to avoid discrepancies.

- Provide your Permanent Account Number (PAN) in the specified field to verify your identity.

- Fill in the details of the premises or building where you reside, including Flat/Door/Block number and the name of the premises.

- Complete the address section with your town, city, and state, ensuring that the details are correct and up to date.

- Indicate the status of your registration as an Association of Persons (Trusts) in the designated field.

- Check the box for whether this is an original or revised return and provide the necessary acknowledgment number.

- In the gross total income section, input the required financial figures from your income tax return forms.

- Complete the deductions under Chapter-VI-A and total income sections as applicable to your financial situation.

- Fill in the details regarding any current year losses and net tax payable as they pertain to your return.

- In the taxes paid section, include all relevant information such as advance tax, TDS, and self-assessment tax.

- Calculate the total taxes paid and check your refund or tax payable status.

- Finalize the verification details by confirming your name and signature in the verification section.

- Enter the date and place of verification along with any required Tax Return Preparer information if applicable.

- Review the completed form for accuracy before proceeding to save changes, download, or print the completed form.

Complete your Incometaxreturnverificationform online today for efficient processing of your income tax return.

An IRS Verification of Non-filing Letter provides proof that the IRS has no record of a filed Form 1040 for the year you requested. Non Tax filers can request an IRS Verification of Non-filing Letter, free of charge, from the IRS in one of three ways: Online. By Telephone. By Paper.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.