Loading

Get Pa Rev 1190 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pa Rev 1190 Instructions online

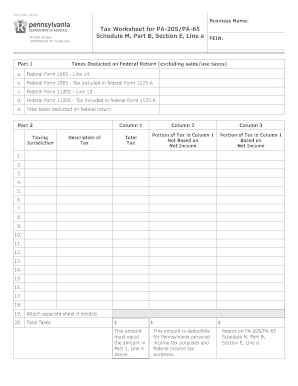

Filling out the Pa Rev 1190 form is an essential step for accurately reporting taxes for partnerships and S corporations in Pennsylvania. This guide provides clear, step-by-step instructions to assist you in completing the form efficiently online.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to access the form and open it in your online editor.

- In Part 1, enter the taxes deducted on your federal return. Provide details for each line as follows: enter amounts from Federal Form 1065 on Line 14 and Federal Form 1120S on Line 12. Ensure to capture any tax amounts included in federal Form 1125-A for accuracy.

- Move to Part 2 to specify the taxing jurisdiction. Here, enter the business name and describe the tax. Make sure to fill Column 1 with the appropriate tax amounts and designate in Columns 2 and 3 the portions of tax not based on net income and those that are based on net income, respectively.

- Calculate the total taxes at the end of Part 2 and ensure this amount matches the total from Part 1, Line e above. This figure is crucial as it will be deductible for Pennsylvania personal and federal income tax purposes.

Complete your Pa Rev 1190 form online today to ensure timely and accurate tax reporting.

The mailing address is: PA Department of Revenue Harrisburg Call Center 6th Floor Strawberry Square-Quad 620 4th and Walnut Street Harrisburg, PA 17128-1210 You should include a copy of the notice...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.