Loading

Get Sts20021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STS20021 online

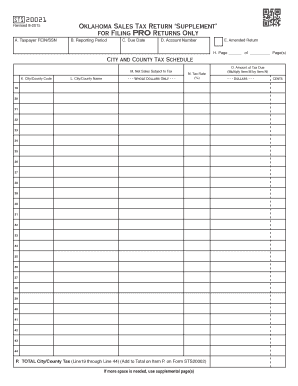

Completing the STS20021 form online is a crucial step for taxpayers participating in the PAYRight OK program. This guide provides detailed instructions to ensure you accurately fill out the form and submit your sales tax return supplement.

Follow the steps to successfully complete your STS20021 form

- Click the ‘Get Form’ button to obtain the STS20021 form and open it in your preferred online editor.

- In Item A, enter your taxpayer identification number (FEIN or SSN) as required for identification purposes.

- In Item B, specify the reporting period by entering the month(s) and year for which the use tax is being reported, starting with the month when you made your first purchase.

- In Item C, provide the due date for the return to ensure timely submission.

- In Item D, enter your Account Number that corresponds with your tax registration.

- If this is an amended return, check the box in Item E to indicate this change.

- In Item H, enter the page number and the total number of pages you are submitting. Ensure this matches the total pages of the form.

- Moving to the City and County Tax Schedule (Lines 19-44), start with Column K by entering the city/county code for each location where you are remitting tax. If you do not know the code, contact the provided assistance line.

- In Column L, print the name of each corresponding city/county based on the codes you have entered.

- For Column M, enter the taxable sales amount for each city/county associated with the codes. If no taxable sales occurred, record a zero.

- In Column N, input the current sales tax rate for each city/county where tax is being remitted.

- In Column O, calculate the sales tax due by multiplying the values from Column M by those in Column N for each city/county.

- Finally, in Item P, add the amounts in Column O from Lines 19 through 44 and enter the total. This figure should be combined with any totals from supplemental pages and reflected on Item P of Form STS20002.

- Once all fields are complete, save your changes, download the form, print it, or share it as necessary.

Complete the STS20021 online today to ensure your participation in the PAYRight OK program.

You have three options for filing and paying your Oklahoma sales tax: File online – File online at OK Tap. You can remit your payment through their online system. File by mail – You can use form STS-20002 to file on paper and by mail. ... AutoFile – Let TaxJar file your sales tax for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.