Loading

Get Boyd County 001 Ot

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Boyd County 001 Ot online

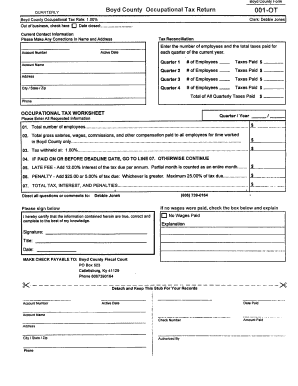

Filling out the Boyd County Occupational Tax Return (001 Ot) online can help you streamline your tax reporting process. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the Boyd County 001 Ot online.

- Click ‘Get Form’ button to obtain the Boyd County 001 Ot and open it in your preferred editor.

- Begin by entering your current contact information, ensuring that your name and address are correct. If there are any changes, please update these details accordingly.

- Fill in the Tax Reconciliation section by entering the number of employees you have and the total taxes paid for each quarter of the current year. Complete all quarters 1 through 4 with the respective data.

- In the Occupational Tax Worksheet section, provide the total number of employees and the total gross salaries, wages, commissions, and other compensation paid to employees within Boyd County.

- Calculate the tax withheld at the rate of 1.00% and enter that amount in the provided field. If you are submitting your payment by the deadline, proceed to calculate the total tax. If not, include any applicable late fees or penalties.

- Sign the form to certify that the information provided is true and complete to the best of your knowledge. If no wages were paid, check the appropriate box and provide a brief explanation.

- Review the entire form for accuracy. Once you are satisfied with the information, you can save your changes, download the document, print it, or share it as needed.

Complete your Boyd County 001 Ot form online today to ensure timely and accurate tax reporting.

What is the sales tax rate in Boyd County? The minimum combined 2023 sales tax rate for Boyd County, Kentucky is 6%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.