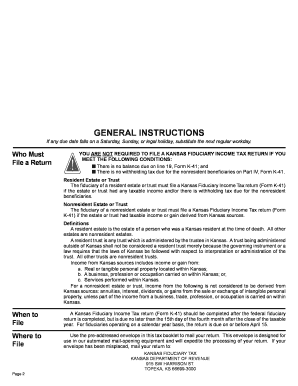

Get Fiduciary Income Tax Instructions (rev. 9-10) - Kansas Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ... online

How to fill out and sign Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ... online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Choosing a authorized expert, creating an appointment and coming to the business office for a personal conference makes doing a Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ... from start to finish exhausting. US Legal Forms allows you to rapidly make legally binding papers based on pre-created web-based samples.

Execute your docs within a few minutes using our easy step-by-step guideline:

- Get the Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ... you want.

- Open it up with cloud-based editor and start adjusting.

- Fill out the blank fields; engaged parties names, addresses and numbers etc.

- Change the blanks with exclusive fillable fields.

- Put the particular date and place your electronic signature.

- Click on Done after double-examining all the data.

- Save the ready-produced document to your device or print it out like a hard copy.

Easily produce a Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ... without needing to involve experts. We already have over 3 million customers benefiting from our unique catalogue of legal documents. Join us right now and gain access to the #1 catalogue of web blanks. Give it a try yourself!

How to edit Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ...: customize forms online

Your quickly editable and customizable Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ... template is within reach. Make the most of our library with a built-in online editor.

Do you postpone completing Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ... because you simply don't know where to begin and how to move forward? We understand how you feel and have an excellent solution for you that has nothing nothing to do with overcoming your procrastination!

Our online catalog of ready-to-edit templates allows you to sort through and pick from thousands of fillable forms adapted for various use cases and scenarios. But getting the document is just scratching the surface. We provide you with all the needed features to complete, certfy, and edit the template of your choice without leaving our website.

All you need to do is to open the template in the editor. Check the verbiage of Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ... and verify whether it's what you’re looking for. Start off modifying the template by taking advantage of the annotation features to give your form a more organized and neater look.

- Add checkmarks, circles, arrows and lines.

- Highlight, blackout, and correct the existing text.

- If the template is meant for other people too, you can add fillable fields and share them for others to complete.

- Once you’re through modifying the template, you can download the document in any available format or pick any sharing or delivery options.

Summing up, along with Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of ..., you'll get:

- A robust suite of editing} and annotation features.

- A built-in legally-binding eSignature solution.

- The option to generate documents from scratch or based on the pre-drafted template.

- Compatibility with various platforms and devices for greater convenience.

- Numerous possibilities for protecting your files.

- A wide range of delivery options for easier sharing and sending out files.

- Compliance with eSignature laws regulating the use of eSignature in electronic transactions.

With our professional option, your completed documents are always legally binding and completely encrypted. We ensure to protect your most delicate details.

Get what is needed to make a professional-hunting Fiduciary Income Tax Instructions (Rev. 9-10) - Kansas Department Of .... Make a good choice and check out our platform now!

Related links form

You'll have to pay back 1% of your family's Child Benefit for every extra £100 you earn over £50,000 each year. This is known as the High Income Child Benefit Tax Charge. To pay the tax charge, you'll need to register for Self Assessment and complete a Self Assessment tax return each year.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.