Loading

Get Truth In Lending Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Truth In Lending Form online

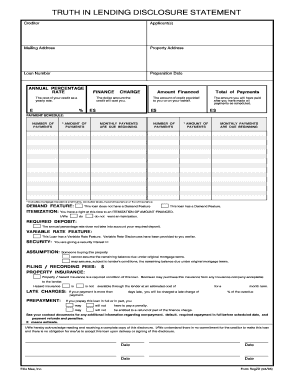

The Truth In Lending Form is a crucial document that outlines important information about your loan. This guide will provide you with clear, step-by-step instructions on how to complete the form online smoothly and accurately.

Follow the steps to fill out the form effectively.

- Click the ‘Get Form’ button to obtain the Truth In Lending Form and open it in your preferred editor.

- In the Creditor section, enter the name of the lending institution offering the loan.

- Fill in the Applicant(s) section with the full name of each person applying for the loan.

- Provide the Mailing Address, which is where correspondence regarding the loan will be sent.

- Input the Property Address for the location of the property being financed.

- Enter the Loan Number if applicable, which is often assigned by the creditor.

- Include the Preparation Date, which is the date on which the form is being filled out.

- For the Annual Percentage Rate section, specify the yearly rate of interest that will be applied to your loan.

- In the Finance Charge field, indicate the total dollar amount that the credit will cost you over the life of the loan.

- Fill out the Amount Financed, which is the total amount of credit provided to you.

- Complete the Total of Payments section with the total amount you will pay over the term of the loan.

- For the Payment Schedule, specify the Number of Payments and Amount of Payments, including the schedule of monthly payments.

- Indicate whether the loan has a Demand Feature by checking the appropriate box.

- Choose whether you want an itemization of the Amount Financed by marking the respective option.

- Indicate if the loan has a Variable Rate Feature and acknowledge that disclosures have been provided.

- Complete the Security section by detailing what security interest you are providing in the loan.

- Decide on the Assumption conditions available for the loan and mark the relevant option.

- Fill in Filing/Recording Fees as necessary.

- Specify the required Property Insurance and complete any associated fields.

- Indicate Late Charges and Prepayment options as applicable to your loan.

- Acknowledge reading and receiving a copy of the disclosure by signing and dating the document.

- Once all the fields are filled, save changes, download a copy, print, or share the completed form as needed.

Begin filling out your Truth In Lending Form online today to ensure you are informed about your loan.

The federal Truth-in-Lending Act - or TILA for short requires that borrowers receive written disclosures about important terms of credit before they are legally bound to pay the loan. ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.