Loading

Get Irs 2011 Pro Forma 990 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2011 Pro Forma 990 Instructions online

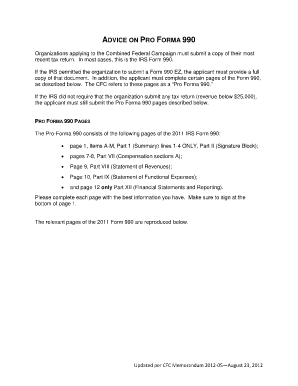

Filling out the IRS 2011 Pro Forma 990 is an essential task for organizations applying to the Combined Federal Campaign. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently, helping you to meet your reporting obligations.

Follow the steps to fill out the IRS 2011 Pro Forma 990 online.

- Click the ‘Get Form’ button to access the IRS 2011 Pro Forma 990 and open it in your editor.

- Complete Page 1 by filling out Items A-M and Part I only for lines 1-4, and ensure you sign at the bottom of this page.

- For Pages 7-8, proceed to Part VII, and provide compensation details for officers, directors, and key employees.

- On Page 9, complete Part VIII, which covers the statement of revenues by detailing all income sources.

- Then, move to Page 10 and complete Part IX, which requires a breakdown of functional expenses.

- Next, on Page 12, fill out Part XII regarding financial statements and reporting requirements.

- Review all provided information for accuracy and completeness.

- Finally, save your changes, download a copy, and consider printing or sharing the completed form as necessary.

Complete your IRS 2011 Pro Forma 990 online today to ensure compliance.

Although they are exempt from income taxation, exempt organizations are generally required to file annual returns of their income and expenses with the Internal Revenue Service. Small tax-exempt organizations with gross receipts under a certain threshold may be required to file an annual electronic notice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.