Loading

Get Michigan Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Michigan Tax Return online

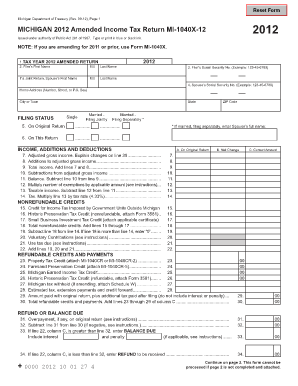

Filing your Michigan Tax Return online can simplify the process and ensure accuracy. This guide will provide you with clear, step-by-step instructions for completing the amended income tax return, MI-1040X-12.

Follow the steps to accurately complete your Michigan Tax Return online.

- Press the ‘Get Form’ button to download the MI-1040X-12 form and open it in your preferred editor.

- Fill in the tax year at the top of the form, which should be 2012. Provide your first name, middle initial, and last name, along with your spouse's information if filing jointly.

- Enter your social security numbers in the designated fields for both the filer and the spouse, if applicable.

- Complete your home address information, including your city, state, and ZIP code.

- Indicate your filing status by checking the appropriate box for single, married filing jointly, or married filing separately.

- Provide the necessary details regarding your income, additions, and deductions, in lines 7 to 14, including adjusted gross income and any applicable credits.

- Fill out nonrefundable credits and refundable credits sections as applicable, making sure to attach any required forms or documentation.

- If changing the number of exemptions, complete line 37, and list your dependents' information in the following lines as required.

- On line 39, provide a detailed explanation of any changes made in your amended return.

- Once all sections are thoroughly completed, review the form for accuracy and save your changes.

- Finally, download and print a copy of your completed return and any attached documentation for your records.

Begin your online filing today to ensure a smooth and efficient tax experience.

Effective immediately, state of Michigan and city of Detroit income tax returns and payments due on April 15 are now due before midnight on July 15. ... The new filing and payment deadlines come after the Internal Revenue Service changed its deadline to July 15 to provide tax assistance due to the COVID-19 pandemic.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.