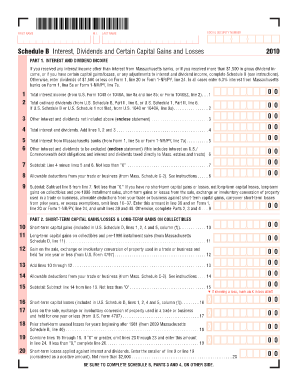

Get massachusetts bank interest exemption

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign What counts as a massachusetts bank for tax purposes online

How to fill out and sign Is bank interest taxable in massachusetts online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The preparing of lawful documents can be high-priced and time-ingesting. However, with our predesigned web templates, things get simpler. Now, working with a If You Received Any Interest Income Other Than Interest From Massachusetts Banks, Or If You takes a maximum of 5 minutes. Our state web-based blanks and clear instructions eradicate human-prone faults.

Follow our easy steps to have your If You Received Any Interest Income Other Than Interest From Massachusetts Banks, Or If You ready quickly:

- Choose the template from the library.

- Complete all required information in the required fillable fields. The user-friendly drag&drop interface allows you to include or move areas.

- Ensure everything is completed appropriately, without any typos or lacking blocks.

- Apply your e-signature to the PDF page.

- Simply click Done to confirm the adjustments.

- Save the data file or print out your copy.

- Send instantly to the recipient.

Make use of the quick search and powerful cloud editor to create a correct If You Received Any Interest Income Other Than Interest From Massachusetts Banks, Or If You. Remove the routine and make papers on the internet!

How to edit Massachusetts bank interest deduction: customize forms online

Have your stressless and paper-free way of editing Massachusetts bank interest deduction. Use our trusted online option and save a great deal of time.

Drafting every form, including Massachusetts bank interest deduction, from scratch requires too much effort, so having a tried-and-tested platform of pre-drafted form templates can do wonders for your productivity.

But editing them can be struggle, especially when it comes to the files in PDF format. Luckily, our extensive library includes a built-in editor that allows you to quickly complete and customize Massachusetts bank interest deduction without leaving our website so that you don't need to lose hours completing your documents. Here's what to do with your document using our solution:

- Step 1. Locate the needed form on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Take advantage of professional modifying features that allow you to add, remove, annotate and highlight or blackout text.

- Step 4. Create and add a legally-binding signature to your document by utilizing the sign option from the top toolbar.

- Step 5. If the document layout doesn’t look the way you want it, utilize the features on the right to erase, add, and arrange pages.

- step 6. Add fillable fields so other persons can be invited to complete the document (if applicable).

- Step 7. Share or send the form, print it out, or select the format in which you’d like to get the document.

Whether you need to complete editable Massachusetts bank interest deduction or any other document available in our catalog, you’re on the right track with our online document editor. It's easy and secure and doesn’t require you to have particular tech background. Our web-based tool is set up to deal with virtually everything you can imagine concerning file editing and execution.

No longer use conventional way of working with your forms. Choose a a professional solution to help you simplify your tasks and make them less reliant on paper.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

What is considered massachusetts bank interest FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to ma bank interest

- what is massachusetts bank interest

- how does massachusetts tax bank interest

- carryover

- C-2

- 1040A

- Pre-1996

- 2011

- sched

- 23a

- 1040EZ

- 27a

- subtotal

- taxable

- allowable

- worksheet

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.