Loading

Get Honorarium Agreement Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Honorarium Agreement Template online

Filling out the Honorarium Agreement Template is essential for formalizing arrangements with guest speakers or performers. This guide will provide clear, step-by-step instructions to help you complete the template accurately and efficiently.

Follow the steps to successfully complete the Honorarium Agreement Template online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

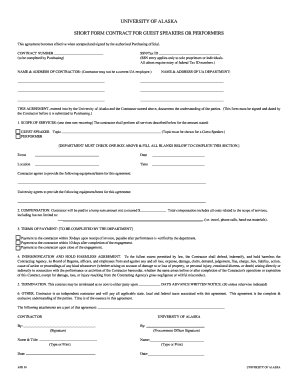

- Enter the contract number in the designated field, as this will be assigned by the purchasing department.

- Provide the SSN or Tax ID in the appropriate section. Note that sole proprietors should enter their SSN, while all others must enter their federal Tax ID numbers.

- Fill in the name and address of the contractor, ensuring that the contractor is not a current employee of the University of Alaska.

- Input the name and address of the UA department requesting the services.

- In the 'Scope of Services' section, specify the topic and indicate whether the contractor is a guest speaker or performer. Complete all blanks related to the event, including date, location, and time.

- List any equipment or items the contractor agrees to provide, followed by the equipment/items that the university will provide.

- In the compensation section, indicate the lump sum amount that will be paid to the contractor, ensuring it does not exceed the stated limit. Include any additional costs related to services.

- The 'Terms of Payment' is to be completed by the department. State the payment time frame according to the options provided.

- Review the indemnification and hold harmless agreement to ensure understanding before signing.

- Complete the termination clause by indicating the number of days' advance written notice required for contract termination.

- Confirm the contractor's status as an independent contractor and understand the tax implications.

- Once all fields are filled, review the document for accuracy, then save changes, download, print, or share the form as needed.

Start filling out the Honorarium Agreement Template online today to secure your arrangements!

Treatment of an Honorarium as Employment Income An honorarium is considered employment income for income tax purposes and is therefore subject to deductions. An honorarium, alongside other related expenses, is reported as taxable income using Form 1040 of IRS Schedule C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.