Loading

Get Canada T1213(oas) E 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1213(OAS) E online

This guide provides a clear and supportive approach to completing the Canada T1213(OAS) E form online. By following this comprehensive step-by-step process, users can effectively manage their requests to reduce Old Age Security recovery tax deductions.

Follow the steps to complete your T1213(OAS) E form online.

- Press the ‘Get Form’ button to obtain the Canada T1213(OAS) E form and access it in the digital editor.

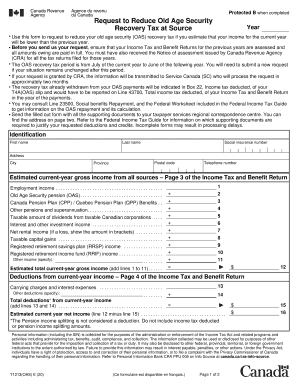

- Begin by filling out the identification section with your first name, last name, social insurance number, and address. Ensure that all information is accurate and up-to-date.

- In the income section, enter your estimated current-year gross income from all sources. Include details of your employment income, Old Age Security pension, Canada Pension Plan benefits, and any other applicable income. Use the provided fields to add up these figures.

- Next, document any deductions from your current-year income such as carrying charges and interest expenses. Complete this section carefully to reflect your financial situation accurately.

- Calculate your estimated current year net income by subtracting total deductions from your gross income. Double-check your calculations before proceeding.

- Complete the non-refundable and refundable tax credits sections as applicable. Specify amounts for any credits you plan to claim, such as disability amounts or medical expenses.

- In the certification section, affirm that the information provided is correct and complete. Include the date and provide your signature to finalize the application.

- Once the form is fully completed, save your changes. You can download the file, print it for your records, or share it as needed.

Complete your Canada T1213(OAS) E form online today to ensure effective management of your Old Age Security recovery tax.

The OAS recovery tax is 15 cents (15%) for every dollar exceeding the minimum threshold amount until OAS is totally eliminated. Let's dig into the numbers. If your total income in 2019 is $95,000, your repayment amount is calculated as: ($95,000 $77,580) = $17,420.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.