Loading

Get 760ip

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 760ip online

Filling out the 760ip form online can simplify your tax payment process and help you avoid potential penalties. This guide provides clear, step-by-step instructions to assist you in completing the form accurately.

Follow the steps to effectively complete the 760ip form online.

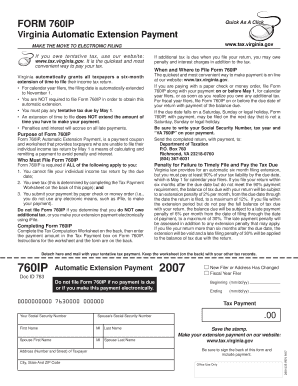

- Press the 'Get Form' button to access the 760ip form and open it in your preferred editing tool.

- Enter your information clearly in the designated fields, including your Social Security Number, name, address, and any relevant details. Ensure that you accurately input the tax year.

- Complete the Tax Computation Worksheet located on the back. Use your anticipated tax liabilities to determine the tentative tax you owe.

- Transfer the tentative tax amount calculated from the worksheet to the Tax Payment box on Form 760ip.

- If you are filing a paper check or money order, ensure you provide your payment with the completed form before the due date of May 1 (for calendar year filers) or with your return for fiscal year filers.

- Finally, review all your entries for accuracy, sign the back of the form, and save any changes. You will have the option to download, print, or share the completed form.

Take the next step and complete your 760ip form online now to ensure timely payment.

Related links form

Interest is assessed at the federal underpayment rate established under Internal Revenue Code Section 6621, plus 2%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.