Loading

Get Cash Paid Out Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cash Paid Out Form online

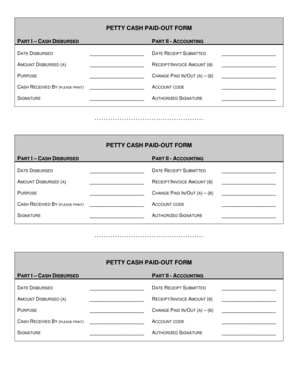

The Cash Paid Out Form is essential for recording cash disbursements within an organization. This guide provides detailed instructions on how to accurately fill out the form online, ensuring that all information is correctly captured and submitted.

Follow the steps to complete the Cash Paid Out Form online

- Use the ‘Get Form’ button to access the Cash Paid Out Form. This will open the form in your chosen online platform.

- Enter the date disbursed in the designated space. This refers to the date on which the cash is being disbursed.

- Fill in the date the receipt is submitted. This indicates when the documentation for the cash disbursement has been submitted for accounting purposes.

- Record the amount disbursed in field (A). This should reflect the total amount of cash given out.

- Input the receipt or invoice amount in field (B). This is the documented amount that should match or correspond to the amount disbursed.

- Describe the purpose of the cash disbursement in the purpose field. This should clearly state why the cash was given out.

- Calculate the change paid in/out by subtracting the receipt/invoice amount (B) from the amount disbursed (A), and place this figure in the corresponding field.

- Provide the name of the person receiving the cash by printing it in the appropriate field.

- Enter the account code associated with this cash disbursement to ensure proper financial tracking.

- Sign your name in the designated signature field. This acts as your acknowledgment of the transaction.

- Finally, include the authorized signature in the specified area to validate the disbursement. This should be from someone with the authority to approve such transactions.

- Once all fields are filled, you can save any changes, download a copy, print the form, or share it as needed.

Complete and submit your Cash Paid Out Form online today to ensure proper documentation of cash disbursements.

A petty cash book is maintained to record small expenses such as postage, stationery, and telegrams. A separate column is used for each type of expenditure. The difference between the sum of the debit items and the sum of the credit items represents the balance of the petty cash in hand.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.