Loading

Get Wisconsin Schedule U

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin Schedule U online

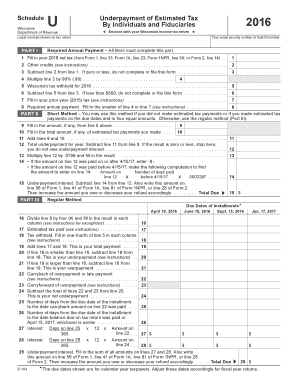

Completing the Wisconsin Schedule U can seem daunting, but with a clear guide, you can navigate each section with confidence. This guide will provide you with a step-by-step approach to filling out the form accurately and efficiently.

Follow the steps to successfully complete your Wisconsin Schedule U.

- Press the 'Get Form' button to access the Wisconsin Schedule U in your preferred format.

- Begin with Part I, where you will fill in your legal name as it appears on your tax return and your social security number or trust ID number. Ensure that this information is accurate as it is critical for your tax filing.

- For line 1, indicate your 2016 net tax by referring to the specified lines from Forms 1, 1A, 1NPR, or 2. This figure is derived from your total tax liability.

- On line 2, report any applicable credits. Carefully review the instructions to identify which credits can be included.

- Line 3 requires you to subtract line 2 from line 1. If the result is zero or less, you do not need to continue filling out the form.

- For line 4, multiply the result from line 3 by 90%. This is necessary to determine your required annual payment.

- In line 5, provide the amount of Wisconsin tax withheld for the year 2016.

- On line 6, subtract line 5 from line 3. If the result is less than $500, you do not need to complete or file this form.

- Enter your prior year (2015) tax amount on line 7, as instructed.

- On line 8, enter the smaller value of line 4 or line 7. This figure represents your required annual payment.

- Move to Part II if you qualify to use the short method, and fill in lines 9 through 12 as instructed to determine underpayment, if applicable.

- If using the regular method in Part III, complete lines 16 through 29 by following the instructions closely for each line to determine your net underpayment or overpayment.

- Complete Part IV if you're using the annualized income installment method. Carefully enter the necessary figures for each column, ensuring accuracy as per the defined periods.

- After completing all relevant sections, review the form thoroughly for any errors or missing information.

- Finally, save your changes, and you may choose to download, print, or share the Wisconsin Schedule U as required.

Start completing your Wisconsin Schedule U online today to ensure accurate tax reporting.

Related links form

Sales Tax Exemptions in Wisconsin There are many exemptions to state sales tax. This includes, burial caskets, certain agricultural items, certain grocery items, prescription medicine and medical devices, modular or manufactured homes, and certain pieces of manufacturing equipment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.