Loading

Get Sample 1065penalty Letter Rp84-35.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample 1065penalty Letter RP84-35.doc online

This guide provides comprehensive instructions on completing the Sample 1065penalty Letter RP84-35.doc efficiently online. By following the detailed steps outlined below, users can ensure all necessary information is accurately included for a successful submission.

Follow the steps to complete the Sample 1065penalty Letter RP84-35.doc

- Press the ‘Get Form’ button to access the document and open it in your preferred online editing format.

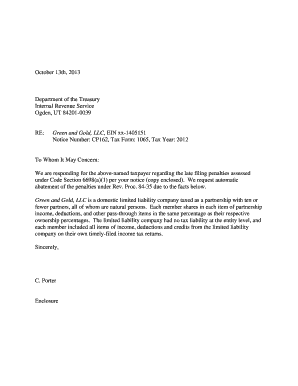

- Begin filling out the header section by entering the name of the entity, 'Green and Gold, LLC', along with the Employer Identification Number (EIN), and notice number. Make sure to correctly input tax form (1065) and the relevant tax year (2012).

- In the body of the letter, introduce your response by addressing the IRS and referencing the penalties assessed under Code Section 6698(a)(1). Clearly indicate that this is a response to the notice received.

- Make a request for automatic abatement of the penalties under Rev. Proc. 84-35. Specify the facts that justify your request, ensuring to outline that Green and Gold, LLC has no tax liability at the entity level and how each member reported their partnership items on their individual tax returns.

- Conclude the letter by signing it, and including the name of the person who is filing the letter, 'C. Porter' in this case, along with any relevant enclosures.

- After completing all sections, review the document for accuracy. Once verified, you can save your changes, download the document, print a hard copy, or share it as required.

Begin filling out your documents online today to streamline your filing process.

Related links form

Failure to File or Pay Penalties Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.