Get Ca De 9 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 9 online

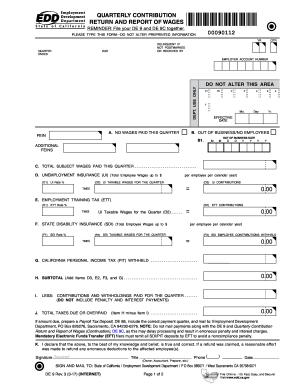

The CA DE 9, or Quarterly Contribution Return and Report of Wages, is an important document for employers in California to report wages and contributions related to unemployment insurance and other taxes. This guide will walk you through the steps needed to complete the CA DE 9 online efficiently.

Follow the steps to accurately complete the CA DE 9 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Verify and enter your Federal Employer Identification Number (FEIN) at the top of the form. Ensure this is the same as your federal account number to avoid discrepancies.

- Indicate the quarter and year this form applies to by filling in the respective boxes.

- If you had no wages paid this quarter, check the box labeled 'A. No wages paid this quarter' and complete Item K.

- If out of business or having no employees, check the box under 'B. Out of business/no employees' and fill in the required date under Item B1.

- Report the total subject wages paid this quarter in Item C. This should reflect all employee payments made during the reporting period.

- Complete Item D regarding Unemployment Insurance: Enter the UI rate in D1, then enter the total UI taxable wages in D2, and calculate the employer's UI contributions to fill in D3.

- Proceed to Item E for Employment Training Tax. Enter the ETT rate in E1 and calculate the contributions in E2 based on UI taxable wages.

- In Item F, fill out the State Disability Insurance section: Enter the SDI rate in F1, report SDI taxable wages in F2, and calculate the contributions in F3.

- Enter any California Personal Income Tax withheld in Item G.

- Calculate the subtotal in Item H by adding the figures from D3, E2, F3, and G.

- Input the total contributions and withholdings paid for the quarter in Item I. Ensure not to include penalty or interest payments.

- Determine the total taxes due or overpaid by subtracting Item I from Item H, and record this in Item J.

- Sign the form in Item K, providing your title, contact number, and date to confirm all information is accurate.

- After completing the form, save your changes. You can also download a copy, print it, or share it as needed.

Complete your CA DE 9 form online today to ensure compliance and avoid penalties.

To fill out California DE 4, you'll start by providing your personal information, including your name, address, and Social Security number. Next, indicate the number of allowances you’re claiming based on your financial situation, which will help determine your withholding amount. It's vital to complete this form accurately to ensure the correct tax is withheld, helping streamline your tax season.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.