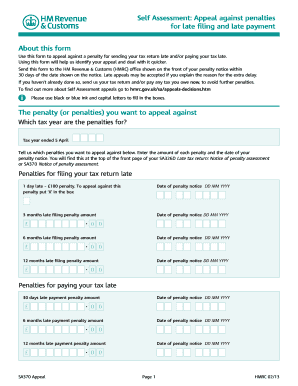

Get Uk Hmrc Sa370 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC SA370 online

How to fill out and sign UK HMRC SA370 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Have you been seeking a quick and convenient tool to fill in UK HMRC SA370 at a reasonable cost? Our platform provides you with a wide collection of forms that are offered for filling in online. It takes only a couple of minutes.

Keep to these simple instructions to get UK HMRC SA370 prepared for submitting:

- Find the sample you require in the collection of legal forms.

- Open the document in the online editing tool.

- Read through the instructions to determine which info you need to include.

- Select the fillable fields and add the necessary information.

- Add the relevant date and insert your electronic signature as soon as you fill out all of the fields.

- Double-check the form for misprints along with other errors. In case there?s a need to change some information, the online editing tool and its wide range of tools are ready for your use.

- Download the filled out form to your computer by clicking on Done.

- Send the e-document to the parties involved.

Completing UK HMRC SA370 does not have to be perplexing any longer. From now on easily get through it from your home or at your business office straight from your mobile or desktop computer.

How to edit UK HMRC SA370: customize forms online

Go with a rock-solid file editing option you can rely on. Edit, complete, and sign UK HMRC SA370 securely online.

Too often, working with documents, like UK HMRC SA370, can be pain, especially if you got them in a digital format but don’t have access to specialized software. Of course, you can find some workarounds to get around it, but you can end up getting a form that won't meet the submission requirements. Utilizing a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We provide an easier and more streamlined way of completing files. A rich catalog of document templates that are easy to customize and certify, to make fillable for others. Our solution extends way beyond a collection of templates. One of the best aspects of using our option is that you can edit UK HMRC SA370 directly on our website.

Since it's an online-based solution, it spares you from having to get any software. Additionally, not all company policies allow you to download it on your corporate computer. Here's how you can easily and securely complete your forms with our solution.

- Click the Get Form > you’ll be instantly redirected to our editor.

- As soon as opened, you can start the editing process.

- Choose checkmark or circle, line, arrow and cross and other choices to annotate your document.

- Pick the date field to add a specific date to your template.

- Add text boxes, graphics and notes and more to complement the content.

- Use the fillable fields option on the right to add fillable {fields.

- Choose Sign from the top toolbar to create and add your legally-binding signature.

- Hit DONE and save, print, and share or get the document.

Forget about paper and other ineffective methods for modifying your UK HMRC SA370 or other documents. Use our tool instead that combines one of the richest libraries of ready-to-edit forms and a robust file editing option. It's easy and safe, and can save you lots of time! Don’t take our word for it, give it a try yourself!

Video instructions and help with filling out and completing executor

Get all you need for completing, editing and signing your Form in a single place. Our simple and quick video instructions take you from beginning to end.

Related links form

HMRC penalties can be expensive and stressful but, thankfully, sometimes they can be appealed. If you have a reasonable excuse, you may be able to lodge an appeal against your penalty from the taxman, and hopefully have it waived.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.