Get Tx H1049 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX H1049 online

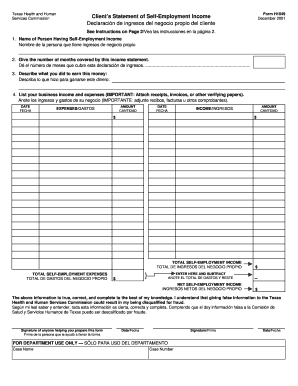

The TX H1049 form, also known as the Client’s Statement of Self-Employment Income, is essential for individuals reporting their self-employment income to the Texas Health and Human Services Commission. This guide will take you through the online process of completing the form step by step, ensuring that you accurately provide the necessary information.

Follow the steps to successfully complete the TX H1049 online.

- Press the ‘Get Form’ button to access the TX H1049 form and open it in the online editor.

- Begin by entering the name of the person who is generating self-employment income in the designated field.

- Indicate the number of months that the self-employment income statement covers.

- Describe the activities performed to earn the reported income. Write a clear and concise description.

- In the income and expenses section, carefully list your business income and expenses. Make sure to input the dates and amounts for each entry. Note that you should attach any receipts or invoices as verification.

- Calculate the total self-employment income by adding all amounts listed under income. Input this total in the relevant box.

- Similarly, calculate the total self-employment expenses and record this amount in the assigned box.

- Subtract the total expenses from total income to determine your net self-employment income and enter this value.

- Review the information for accuracy to ensure it is complete and truthful.

- Sign and date the form. If someone assisted you in filling it out, their signature is also required.

- Once all fields are filled out and accurate, save any changes, then download, print, or share the form as needed.

Complete your documents online today to streamline your application process.

Get form

To obtain emergency food stamps as soon as possible, submit your application online or visit your local office. Provide all required documentation to prevent delays in processing. If you find the process overwhelming, uslegalforms can offer support and detailed guidance throughout the application for faster access to the TX H1049 benefits you need.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.