Loading

Get Pa Rev 1313

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pa Rev 1313 online

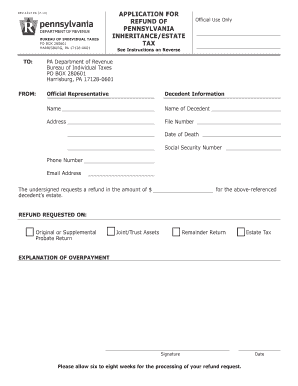

The Pa Rev 1313 form is an application for a refund of Pennsylvania inheritance or estate tax. This guide will walk you through the steps to fill out the form online, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to successfully complete the Pa Rev 1313 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the decedent information section. Enter the name of the deceased individual, including their first and last name.

- Complete the address section by including the first and second line of the address, city, state, and ZIP code.

- Input the decedent’s file number, which should be formatted similarly to '08/15/2004'.

- Provide the date of death of the decedent, following the same format as the file number.

- Enter the decedent’s social security number, phone number, and email address in the corresponding fields.

- Indicate the refund requested on the form by selecting one of the options: original or supplemental probate return, joint/trust assets, remainder return, or estate tax.

- In the explanation of overpayment section, clearly state the reasons for the refund request.

- After completing the form, print it out for signing. Remember that electronic signatures are not accepted.

- Save changes, then download, print, or share the form as needed. Ensure to send it to the appropriate address provided on the form.

Complete your Pa Rev 1313 form online today to ensure your refund request is processed promptly.

In California, there is no state-level estate or inheritance tax. If you are a California resident, you do not need to worry about paying an inheritance tax on the money you inherit from a deceased individual. As of 2023, only six states require an inheritance tax on people who inherit money.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.