Loading

Get Canada T3010 E 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T3010 E online

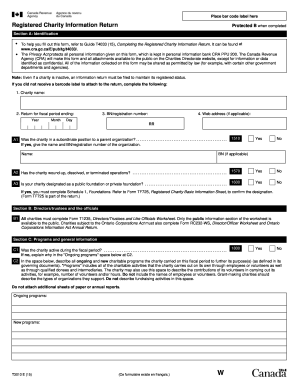

The Canada T3010 E is an essential form for registered charities in Canada, providing crucial information to the Canada Revenue Agency. This guide will help you navigate each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete the Canada T3010 E online.

- Press the ‘Get Form’ button to obtain the form and access it in the editor.

- Fill out Section A: Identification. Include the charity's name, fiscal period ending date, and BN/registration number. If your charity has a web address, provide it here as well.

- In Section A1, specify whether the charity was subordinate to a parent organization by indicating yes or no, and provide the parent organization’s name and registration number if applicable.

- For Section A2, confirm if the charity has wound up, dissolved, or terminated operations by selecting yes or no.

- Section A3 allows you to indicate if the charity is designated as a public or private foundation. If yes, proceed to complete Schedule 1.

- In Section B, ensure to complete Form T1235 for directors and trustees. This information is necessary for compliance.

- Section C requires details about the charity's activities. Start by stating whether the charity was active during the fiscal period in question C1.

- For question C2, describe ongoing and new charitable programs in the space provided, focusing on contributions by volunteers and activities conducted, avoiding fundraising details.

- Proceed to questions C3 to C9 to indicate any gifts made to qualified donees, fundraising methods, and details about political activities if applicable.

- If completing Section D, provide total revenue and expenditures, ensuring all fields are filled accurately. If revenue exceeds $100,000, then proceed to Schedule 6.

- At Section E, a person authorized must certify the information provided. Make sure to include their signature, printed name, position, date, and telephone number.

- Ensure you enter the physical address for the charity as required in Section F, and provide the contact information of the individual who completed the return.

- Once all sections are completed, review the document for accuracy before saving changes, downloading, printing, or sharing the form as needed.

Start completing your Canada T3010 E form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file donations on your taxes in Canada, you need to gather receipts for your charitable contributions and report them on your tax return. The Canada T3010 E form is specifically for registered charities reporting their income, while you will use the Schedule 9 for your personal donations. Accurate records are crucial, so utilizing a service like US Legal Forms can simplify this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.