Loading

Get Tr Trtr Tr Tr - Fcs Namibia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tr Trtr Tr Tr - FCS Namibia online

This guide provides step-by-step instructions on how to accurately complete the Tr Trtr Tr Tr - FCS Namibia form online. Following these instructions will ensure that your application is filled out correctly and efficiently.

Follow the steps to complete the Tr Trtr Tr Tr - FCS Namibia form online.

- Press the ‘Get Form’ button to access the Tr Trtr Tr Tr - FCS Namibia form and open it in your preferred editing tool.

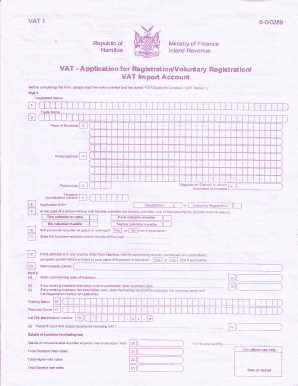

- In Part 1, enter your registered name accurately, which should reflect the legal entity as it appears on legal documents. If it is a partnership, include the names of the partners.

- Provide the trade name of your business if it differs from the registered name.

- Indicate the full address of your main place of business.

- Fill in the postal address to use for mailing purposes.

- Insert the postal code if you have one; leave blank if not.

- Specify the magisterial district where your business is located.

- List your taxpayer identification number, which can be obtained from your income tax certificate.

- Select the type of application you are making: for registration, voluntary registration, or VAT import account.

- If applicable, indicate whether you will be an exporter of goods or services.

- Provide the business address where accounting records will be kept.

- Confirm if your accounting records are maintained on a centralized computer system if located outside Namibia.

- Describe the main taxable activity of your business, such as wholesale or retail.

- Enter the commencing date of the business.

- If you took over an existing business, include the date of purchase.

- Provide details about any previous owner and their VAT registration number if applicable.

- State the value of stock and assets transferred at the time of acquisition.

- Detail your turnover excluding tax, including total annual taxable supplies of goods and or services.

- Estimate your total standard rate, higher rate, and exempt rate sales.

- If applicable, include details of branches and specify if they have an independent accounting system.

- Present the completed form to your bank for confirmation of your bank account.

- Declare under your signature that all particulars given are correct and submit the application.

- Finally, you can save changes, download, print, or share your completed form.

Complete your documents online today for a seamless experience.

Related links form

The ICAO phonetic alphabet has assigned the 26 code words to the 26 letters of the English alphabet in alphabetical order: Alfa, Bravo, Charlie, Delta, Echo, Foxtrot, Golf, Hotel, India, Juliett, Kilo, Lima, Mike, November, Oscar, Papa, Quebec, Romeo, Sierra, Tango, Uniform, Victor, Whiskey, X-ray, Yankee, Zulu.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.