Get Freddie Mac / Fannie Mae 3034 2001-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac / Fannie Mae 3034 online

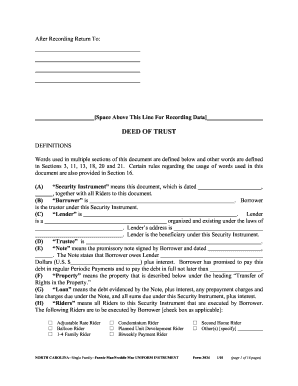

The Freddie Mac / Fannie Mae 3034 form is a critical document used in securing loans for properties. This guide will provide you with clear and easy-to-follow instructions for completing the form online, ensuring you understand each section and field thoroughly.

Follow the steps to fill out the Freddie Mac / Fannie Mae 3034 online efficiently.

- Press the ‘Get Form’ button to access the Freddie Mac / Fannie Mae 3034 document online.

- Begin with the definitions section, where you will find key terms that are essential for understanding the rest of the document. Fill in any applicable fields such as 'Borrower', 'Lender', and 'Trustee'.

- Proceed to the 'Transfer of Rights in the Property' section. Input the jurisdiction and physical address of the property being secured.

- In the 'Loan' section, accurately complete the amount owed, including any interest descriptions as specified.

- Check any applicable Riders you will be executing with the Security Instrument. Ensure to include the details for options like the Adjustable Rate Rider or Balloon Rider.

- Continue through the Uniform Covenants section, understanding that you are agreeing to the covenants by simply signing the form.

- Review the details you've entered carefully before finalizing. Ensure all definitions are correctly filled out and correspond to your details.

- Once completed, you can save changes, download a copy for your records, print the form for submission, or share it as needed.

Complete your documents online for a smoother loan process.

Not all conventional loans fall under Fannie Mae or Freddie Mac guidelines. While a significant portion of conventional loans is backed by these entities, some may originate from private lenders or other sources. It's essential to understand that Fannie Mae and Freddie Mac play vital roles in the mortgage market, helping to ensure liquidity and stability. For those interested in navigating these options, the US Legal Forms platform provides helpful resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.