Get Canada T1 General 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1 General online

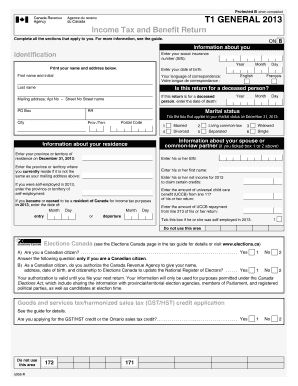

The Canada T1 General form is essential for individuals to report their income and claim benefits. This guide will provide a clear and informative pathway for users to effectively complete the form online, ensuring all necessary information is accurately filled out.

Follow the steps to complete your Canada T1 General online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the identification section. Provide your social insurance number (SIN) and your date of birth.

- Print your name, address, and choose your preferred language of correspondence. Include details such as city, province/territory, and postal code.

- Indicate your marital status as of December 31. Select the option that applies to you: single, married, separated, divorced, common-law, or widowed.

- If applicable, provide information about your spouse or common-law partner, including their SIN and net income.

- Fill in your financial details in the income section, detailing sources such as employment income, pensions, investments, and any other income. Ensure to include all relevant figures from slips and forms.

- Complete the deductions section, listing any possible deductions such as RRSP contributions, child care expenses, and other eligible expenses to reduce your taxable income.

- Calculate your total income and net income as per the instructions, applying the appropriate lines as referenced in the guide.

- Determine your taxable income by subtracting your deductions from your net income, ensuring that the result is not negative.

- Complete the refund or balance owing section to determine if you owe taxes or will receive a refund. Include all relevant calculations.

- Finally, attach any required schedules and signatures. Ensure all information is precise and correct, and submit your completed form.

- At the end of the process, save your changes, download, print, or share the form as necessary.

Start completing your Canada T1 General online today for a smoother tax filing experience.

Get form

The T1 form, specifically the T1 General, is utilized by Canadians to report their annual income to the CRA. This form encompasses various sections to detail income from employment, investments, and other sources, along with applicable deductions and credits. Proper completion of the T1 form is vital for accurate tax calculations and potential refunds. Platforms like UsLegalForms can guide users through the T1 preparation process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.