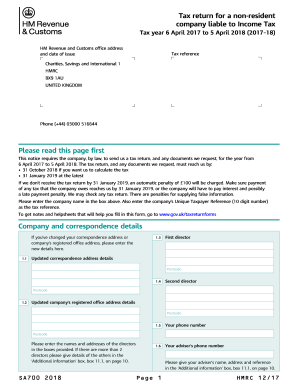

Get Uk Hmrc Sa700 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC SA700 online

How to fill out and sign UK HMRC SA700 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The prep of lawful documents can be high-priced and time-consuming. However, with our predesigned web templates, everything gets simpler. Now, working with a UK HMRC SA700 takes no more than 5 minutes. Our state online blanks and complete recommendations remove human-prone errors.

Adhere to our simple steps to have your UK HMRC SA700 prepared quickly:

- Choose the web sample from the catalogue.

- Complete all required information in the necessary fillable areas. The user-friendly drag&drop interface makes it easy to add or move fields.

- Ensure everything is filled in properly, without any typos or absent blocks.

- Place your electronic signature to the PDF page.

- Simply click Done to save the alterations.

- Download the data file or print out your copy.

- Submit instantly to the recipient.

Take advantage of the quick search and innovative cloud editor to create an accurate UK HMRC SA700. Get rid of the routine and create documents on the internet!

How to modify UK HMRC SA700: customize forms online

Take away the mess from your paperwork routine. Discover the simplest way to find and edit, and file a UK HMRC SA700

The process of preparing UK HMRC SA700 needs precision and focus, especially from those who are not well familiar with this sort of job. It is essential to find a suitable template and fill it in with the correct information. With the proper solution for handling paperwork, you can get all the instruments at hand. It is easy to simplify your editing process without learning additional skills. Locate the right sample of UK HMRC SA700 and fill it out immediately without switching between your browser tabs. Discover more instruments to customize your UK HMRC SA700 form in the modifying mode.

While on the UK HMRC SA700 page, just click the Get form button to start modifying it. Add your data to the form on the spot, as all the essential instruments are at hand right here. The sample is pre-designed, so the work required from the user is minimal. Just use the interactive fillable fields in the editor to easily complete your paperwork. Simply click on the form and proceed to the editor mode right away. Fill in the interactive field, and your file is all set.

Try out more instruments to customize your form:

- Place more text around the document if needed. Use the Text and Text Box instruments to insert text in a separate box.

- Add pre-designed graphic elements like Circle, Cross, and Check with respective instruments.

- If needed, capture or upload images to the document with the Image tool.

- If you need to draw something in the document, use Line, Arrow, and Draw instruments.

- Try the Highlight, Erase, and Blackout tools to customize the text in the document.

- If you need to add comments to specific document sections, click on the Sticky tool and place a note where you want.

Often, a small error can ruin the whole form when someone completes it by hand. Forget about inaccuracies in your paperwork. Find the samples you need in moments and finish them electronically via a smart modifying solution.

Yes, owning a business allows you to claim a tax return if you have overpaid taxes or are eligible for certain reliefs. Understanding deductions for business expenses is crucial, and knowing the requirements, like those outlined in the UK HMRC SA700, can enhance your refund potential. Using platforms like uslegalforms can streamline this process for business owners.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.