Loading

Get Ira Transfer Due To Divorce Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA Transfer Due To Divorce Request online

This guide provides clear, step-by-step instructions to help you complete the IRA Transfer Due To Divorce Request form online. By following these instructions, you will be able to fill out the necessary information with confidence.

Follow the steps to complete the IRA Transfer Due To Divorce Request form.

- Click the ‘Get Form’ button to access the IRA Transfer Due To Divorce Request form and open it in your preferred online editor.

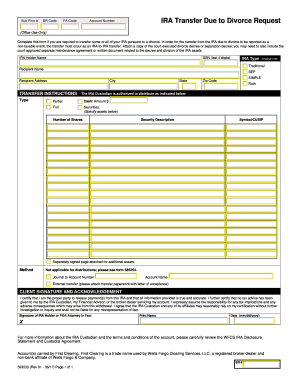

- Begin filling in the ‘IRA Holder Name’ field with your full name as the current holder of the IRA. This identifies you as the person initiating the transfer.

- Provide the last four digits of your Social Security Number (SSN) in the designated field for verification purposes.

- Select the type of IRA you are transferring from the options provided: Traditional, SEP, SIMPLE, or Roth. This determines the specific rules that apply to your account.

- Fill in the ‘Account Number’ field to specify which account is being transferred for identification by the IRA Custodian.

- Enter the ‘Recipient Name’ and ‘Recipient Address’ (including City, State, and Zip Code) to designate where the funds will be transferred.

- In the ‘TRANSFER INSTRUCTIONS’ section, indicate whether this is a partial or full transfer by selecting the appropriate option.

- If choosing a partial transfer, specify the amount in cash, or detail the securities being transferred including their number of shares, description, and symbol/CUSIP.

- If applicable, attach a separate signed page for any additional assets that need to be transferred.

- Indicate the method of transfer, including options like journal to an account number or external transfer, ensuring to attach all necessary paperwork.

- Read and acknowledge the client signature and acknowledgment section, where you certify that all information is accurate and that you assume responsibility for any tax implications.

- Finally, sign and date the form in the designated fields, ensuring that your signature corresponds to the name provided.

- Once all fields are filled accurately, save changes, and utilize options to download, print, or share the completed form as necessary.

Start completing your IRA Transfer Due To Divorce Request form online today.

The quick answer is no. Divorce does not usually change a beneficiary designation unless the divorce decree includes a stipulation to change it. Individual retirement accounts (IRAs) work the same way.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.