Get Ca Boe-58-ah 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA BOE-58-AH online

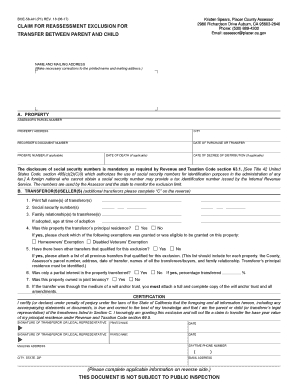

The CA BOE-58-AH form is essential for claiming reassessment exclusion for property transfers between parents and children in California. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the CA BOE-58-AH form online

- Click ‘Get Form’ button to access the CA BOE-58-AH form and open it in your preferred digital editor.

- Begin by completing the 'Name and Mailing Address' section. Ensure to correct any printed information if necessary, and enter the information as it should appear.

- In Section A, provide the property's Assessor’s Parcel Number and address, along with the City, Recorder’s Document Number, Date of Purchase or Transfer, and any applicable Probate Number, Date of Death, and Date of Decree of Distribution.

- Proceed to Section B to list the transferor(s)/seller(s) details. Fill in the full names, social security numbers, and their relationship to the transferee(s). Also, indicate if the property was the transferor’s principal residence.

- Complete all relevant questions regarding previous transfers eligible for exclusion, partial interests, and joint tenancy status in Section B.

- Certify the information by signing and dating the form. Ensure all transferor or legal representative signatures are collected.

- Move to Section C to enter transferee(s)/buyer(s) details. Similar to Step 4, provide their names, family relationships, and other required details.

- Allocate any exclusions if the property value exceeds one million dollars and ensure all information is complete.

- Finalize the form by printing or saving your changes. You can either download the completed form or print it directly for submission.

Complete your CA BOE-58-AH form online today to ensure your property transfer is processed efficiently.

The CA senior exemption credit is a financial benefit available to eligible seniors, aimed at reducing property tax liabilities. This exemption is particularly relevant for those aged 62 and older, providing considerable savings. By completing the CA BOE-58-AH form, seniors can apply for this exemption and potentially enhance their financial flexibility. Engaging with this process can lead to significant advantages in tax payments.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.