Get Uk Hmrc Sa370 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC SA370 online

How to fill out and sign UK HMRC SA370 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Have you been seeking a quick and convenient tool to fill in UK HMRC SA370 at a reasonable cost? Our platform provides you with a wide collection of forms that are offered for filling in online. It takes only a couple of minutes.

Keep to these simple instructions to get UK HMRC SA370 prepared for submitting:

- Find the sample you require in the collection of legal forms.

- Open the document in the online editing tool.

- Read through the instructions to determine which info you need to include.

- Select the fillable fields and add the necessary information.

- Add the relevant date and insert your electronic signature as soon as you fill out all of the fields.

- Double-check the form for misprints along with other errors. In case there?s a need to change some information, the online editing tool and its wide range of tools are ready for your use.

- Download the filled out form to your computer by clicking on Done.

- Send the e-document to the parties involved.

Completing UK HMRC SA370 does not have to be perplexing any longer. From now on easily get through it from your home or at your business office straight from your mobile or desktop computer.

How to edit UK HMRC SA370: customize forms online

Take advantage of the functionality of the multi-featured online editor while completing your UK HMRC SA370. Use the diversity of tools to rapidly fill out the blanks and provide the requested information right away.

Preparing paperwork is time-consuming and expensive unless you have ready-to-use fillable forms and complete them electronically. The simplest way to cope with the UK HMRC SA370 is to use our professional and multi-featured online editing solutions. We provide you with all the important tools for quick document fill-out and allow you to make any edits to your templates, adapting them to any needs. Aside from that, you can make comments on the updates and leave notes for other parties involved.

Here’s what you can do with your UK HMRC SA370 in our editor:

- Complete the blanks using Text, Cross, Check, Initials, Date, and Sign tools.

- Highlight essential information with a desired color or underline them.

- Hide sensitive information with the Blackout option or simply remove them.

- Import images to visualize your UK HMRC SA370.

- Replace the original text with the one suiting your requirements.

- Add comments or sticky notes to communicate with others about the updates.

- Drop extra fillable areas and assign them to specific recipients.

- Protect the sample with watermarks, place dates, and bates numbers.

- Share the paperwork in various ways and save it on your device or the cloud in different formats once you finish modifying.

Dealing with UK HMRC SA370 in our robust online editor is the fastest and most efficient way to manage, submit, and share your documentation the way you need it from anywhere. The tool works from the cloud so that you can utilize it from any place on any internet-connected device. All templates you generate or complete are securely stored in the cloud, so you can always open them whenever needed and be confident of not losing them. Stop wasting time on manual document completion and eliminate papers; make it all on the web with minimum effort.

Related links form

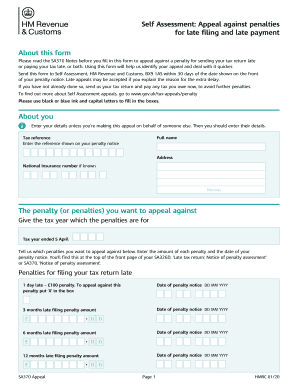

The appeal should normally be made within 30 days of the penalty notice being issued, but HMRC may consider late appeals. If HMRC does not allow your late appeal, you can apply to the Tax Tribunal to have your appeal allowed. Appeals need to be made in writing and this may be done using form sa 370.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.