Loading

Get Irs Publication 5419 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Publication 5419 online

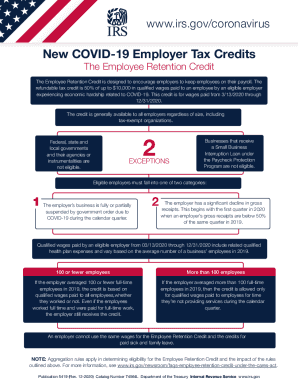

Filling out IRS Publication 5419 is essential for employers seeking to understand and claim COVID-19-related tax credits. This guide provides clear, step-by-step instructions to help users easily navigate the online form and secure the benefits available to them.

Follow the steps to accurately complete the IRS Publication 5419 online.

- Press the ‘Get Form’ button to acquire the form and access it in your preferred online editing platform.

- Carefully review the eligibility requirements outlined on the form, ensuring that your business qualifies for the Employee Retention Credit or the Leave Credits based on the specific criteria.

- Fill in your business details in the designated fields, including your employer identification number, legal business name, and contact information.

- Detail the average number of full-time employees your business had in 2019 to determine which sections of the form apply to you.

- Provide information regarding qualified wages paid during the specified period, ensuring that all amounts are accurate and reflect wages paid to eligible employees.

- Include any related qualified health plan expenses and other necessary data as prompted in the subsequent fields.

- After completing the form, review all entries for accuracy and completeness, making any necessary adjustments before finalization.

- Once fully satisfied, users can save their changes, download the form for personal records, print the document for submission, or share it as needed.

Complete your IRS Publication 5419 online today to take advantage of the available tax credits!

How tax credits work. A tax credit is a dollar-for-dollar reduction of the income tax you owe. For example, if you owe $1,000 in federal taxes but are eligible for a $1,000 tax credit, your net liability drops to zero.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.