Loading

Get Medical Professionals Expense

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Medical Professionals Expense online

This guide provides a detailed overview of how to complete the Medical Professionals Expense form online. By following these instructions, you can ensure that all necessary information is accurately provided for your expense claims.

Follow the steps to accurately complete your form

- Press the ‘Get Form’ button to access the Medical Professionals Expense form and open it in your preferred editor.

- Begin by entering your personal information in the designated fields. This may include your name, contact details, and professional identification, ensuring everything is accurate and up-to-date.

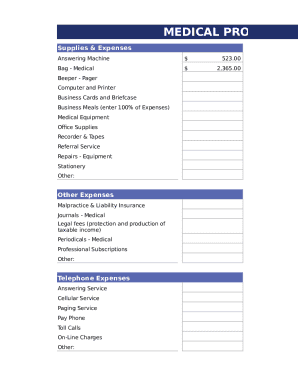

- Proceed to the 'Supplies & Expenses' section. Here, you will need to list all relevant expenses such as answering machines, medical bags, and other equipment. Enter each item's cost in the spaces provided.

- Move on to 'Other Expenses.' Include details about malpractice insurance, legal fees, and any professional subscriptions. Make sure to itemize each expense accurately.

- In the 'Telephone Expenses' section, provide a breakdown of your telephone-related expenses, such as cellular service and toll calls. Enter the amounts where indicated.

- Fill in the 'Uniforms & Upkeep' section by detailing expenses related to your work attire. Specify costs associated with uniforms, cleaning, and alterations.

- Next, complete the 'Continuing Education' section. Enter all educational expenses, including lodging, meals, and course fees, separately so that they are not combined.

- In the 'Travel - Out of Town' section, list any travel expenses incurred for professional purposes, such as airfare, car rentals, and other transportation costs.

- Complete the 'Professional Fees & Dues' section with expenses related to memberships and dues for medical and professional associations.

- Finally, ensure all expenses are totaled accurately, summarizing all amounts to reflect a clear picture of your medical expenses.

- Once you have filled out all sections, review your entries for accuracy and completeness. After confirming everything is correct, save your changes. You may choose to download, print, or share the completed form as needed.

Start filling out your Medical Professionals Expense form online today for a seamless submission experience.

Professional Expenses means any out-of-pocket fees, costs and expenses incurred in respect of legal, accounting, consulting, investment banking or other bona fide professional or advisory services, including any printing, duplicating, travel and other customary costs and expenses incurred in connection with such ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.