Loading

Get Us Treasury Check Watermark

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the U.S. Treasury Check Watermark online

Filling out the U.S. Treasury Check Watermark form is essential for ensuring compliance and authenticity in financial transactions. This guide provides a comprehensive approach to completing the form accurately, enhancing your awareness of its components and their significance.

Follow the steps to accurately fill out the U.S. Treasury Check Watermark form online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

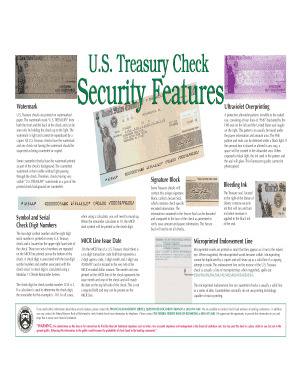

- Familiarize yourself with the watermark feature. Ensure the watermark reading 'U.S. TREASURY' is visible when the form is held up to the light. This authenticity measure is crucial to validate that the check is legitimate.

- Locate the symbol and serial check digit numbers on the upper right hand side of the check. Make sure that both numbers play a key role in verifying the authenticity of the check.

- If applicable, look for the Secure Seal signature block. This unique security feature contains check-specific encoded information that verifies the check's details.

- Observe the bleeding ink feature near the Treasury seal, ensuring it exhibits the expected reaction to moisture. This is another security measure against counterfeiting.

- Check the MICR line to confirm the presence of a six-digit transaction code indicating the issue date. This should align with the date presented on the left side of the form.

- Examine for microprinted words, particularly on the endorsement line. When magnified, the microprint should read 'USA' repeatedly; if it appears as a solid line, this could indicate a counterfeit check.

- Once you have filled out the necessary information and verified all security features, save your changes, download, print, or share the completed form as needed.

Complete your documents online now for efficient and secure processing.

Related links form

The payments are being made to people who filed a 2019 return by this year's July 15 deadline and either received a refund in the past three months or will receive a refund in the future, according to the IRS. Most interest payments will be issued separately from the tax refunds themselves.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.