Loading

Get Arizona Irrevocable Trust Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Irrevocable Trust Template online

Creating an irrevocable trust is an essential step in estate planning that allows individuals to manage their assets effectively. This guide will provide you with clear, step-by-step instructions on how to complete the Arizona Irrevocable Trust Template online, ensuring that your trust is accurately filled out and legally sound.

Follow the steps to fill out the Arizona Irrevocable Trust Template online.

- Click ‘Get Form’ button to obtain the Arizona Irrevocable Trust Template and open it in your preferred online editor.

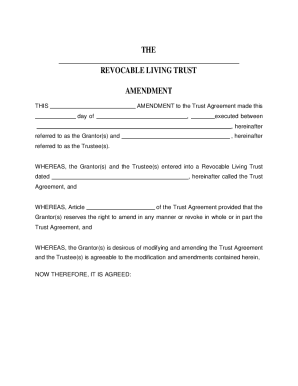

- Begin by filling in the title section at the top of the document. This usually includes the name of the trust, such as 'The [Your Last Name] Irrevocable Trust'. Make sure to use the correct legal title.

- Next, provide the date the trust is being established. This is important for legal and record-keeping purposes.

- In the section for the Grantors, list the individuals who are creating the trust. Include their full names and address details to ensure clarity regarding ownership and responsibility.

- Continuing, you will identify the trustee or trustees who will manage the trust. List the full names and any relevant contact information. Up to multiple trustees can be named if desired.

- Next, specify the beneficiaries of the trust. This section should include the beneficiaries’ full names and relationship to the Grantors, along with any specific provisions or allocations of trust assets.

- Review the instructions regarding amendments and revocation. Make sure to fill in any details concerning the power to modify the trust as needed.

- Once the form is filled out completely, review all entries for accuracy. Ensure that all required information is provided and double-check spellings of names and locations.

- When you have confirmed that the document is correct, save the changes, and sign where indicated. Sometimes, electronic signatures are acceptable, but check state requirements.

- Finally, download or print the completed trust document for your records. It may also be wise to share a copy with a trusted family member or an estate planning attorney.

Start your document preparation today and complete your Arizona Irrevocable Trust Template online.

An irrevocable trust cannot be revoked, modified, or terminated by the grantor once created, except with the permission of the beneficiaries. The grantor is not allowed to withdraw any contributions from the irrevocable trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.