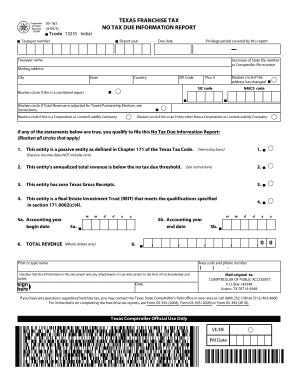

Get Texas Franchise Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Texas Franchise Tax online

How to fill out and sign Texas Franchise Tax online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Legal, tax, business and other e-documents require higher of compliance with the law and protection. Our forms are regularly updated in accordance with the latest amendments in legislation. In addition, with our service, all the details you include in your Texas Franchise Tax is well-protected from loss or damage via cutting-edge encryption.

The following tips can help you fill in Texas Franchise Tax quickly and easily:

- Open the document in our full-fledged online editor by hitting Get form.

- Fill out the required boxes that are yellow-colored.

- Click the green arrow with the inscription Next to jump from field to field.

- Use the e-autograph solution to add an electronic signature to the template.

- Put the date.

- Look through the entire document to be sure that you have not skipped anything.

- Click Done and save the resulting document.

Our service allows you to take the whole process of executing legal papers online. Due to this, you save hours (if not days or even weeks) and eliminate extra expenses. From now on, complete Texas Franchise Tax from home, office, or even on the move.

How to edit Texas Franchise Tax: customize forms online

Take full advantage of our comprehensive online document editor while completing your forms. Complete the Texas Franchise Tax, point out the most significant details, and effortlessly make any other essential changes to its content.

Preparing documentation electronically is not only time-saving but also gives a possibility to alter the template according to your demands. If you’re about to manage the Texas Franchise Tax, consider completing it with our comprehensive online editing tools. Whether you make a typo or enter the requested details into the wrong field, you can rapidly make adjustments to the form without the need to restart it from the beginning as during manual fill-out. Apart from that, you can stress on the critical data in your paperwork by highlighting certain pieces of content with colors, underlining them, or circling them.

Adhere to these simple and quick steps to fill out and adjust your Texas Franchise Tax online:

- Open the file in the editor.

- Provide the required information in the blank fields using Text, Check, and Cross tools.

- Adhere to the document navigation to avoid missing any essential fields in the template.

- Circle some of the important details and add a URL to it if necessary.

- Use the Highlight or Line tools to stress on the most significant facts.

- Decide on colors and thickness for these lines to make your sample look professional.

- Erase or blackout the facts you don’t want to be visible to others.

- Substitute pieces of content containing mistakes and type in text that you need.

- Finish editing with the Done option as soon as you ensure everything is correct in the document.

Our powerful online solutions are the most effective way to fill out and customize Texas Franchise Tax in accordance with your needs. Use it to prepare personal or business documentation from anyplace. Open it in a browser, make any adjustments to your documents, and get back to them at any time in the future - they all will be safely stored in the cloud.

In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375%. Businesses with receipts less than $1.18 million pay no franchise tax.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.