Loading

Get Mo Dor Mo-hea 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-HEA online

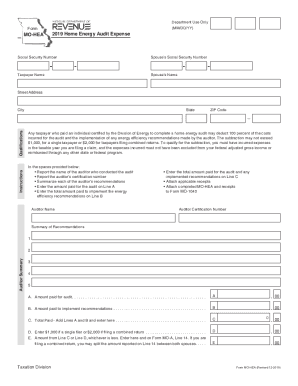

The MO DoR MO-HEA form is essential for taxpayers who have incurred expenses for a home energy audit. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the MO DoR MO-HEA form online.

- Press the ‘Get Form’ button to access the form and load it in your online editor.

- In the designated fields, enter your taxpayer name and your street address, along with your city, state, and ZIP code. Additionally, provide your Social Security Number as well as your spouse’s Social Security Number, if applicable.

- Input the name of the auditor who conducted the home energy audit and their certification number in the specified areas.

- Summarize each recommendation made by the auditor in the provided sections. Ensure all details are clear and concise.

- Enter the amount paid for the audit on Line A and the total amount paid to implement the auditor’s energy efficiency recommendations on Line B.

- Calculate the total amount paid for both the audit and the recommendations and enter this amount on Line C.

- Specify the maximum deductible amount on Line D, which is $1,000 for single filers or $2,000 for those filing combined returns.

- On Line E, enter the lesser amount between Line C or Line D. This figure should also be reported on Form MO-A, Line 14.

- Make sure to attach the necessary receipts and the completed MO-HEA form to Form MO-1040.

- Finally, review all entered information for accuracy. Save your changes, download, print, or share the completed form as needed.

Complete your MO DoR MO-HEA form online today to take advantage of your energy audit deductions.

Related links form

Use this form to file a refund claim for the Missouri motor fuel tax increase(s) paid beginning October 1, 2021, through June 30, 2022, for motor fuel used for on road purposes. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.