Get Irs Publication 786

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Irs Publication 786 online

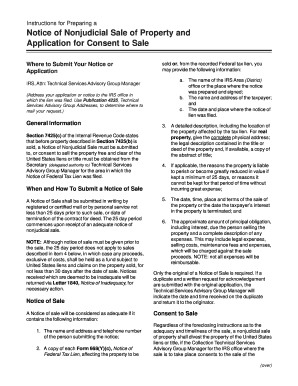

How to fill out and sign Irs Publication 786 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Getting a legal specialist, creating an appointment and coming to the business office for a personal meeting makes finishing a Irs Publication 786 from start to finish stressful. US Legal Forms enables you to rapidly generate legally valid papers according to pre-created online samples.

Perform your docs within a few minutes using our straightforward step-by-step guideline:

- Get the Irs Publication 786 you need.

- Open it using the cloud-based editor and start editing.

- Fill out the empty areas; concerned parties names, addresses and numbers etc.

- Change the template with exclusive fillable areas.

- Add the particular date and place your e-signature.

- Click on Done after double-examining everything.

- Download the ready-created record to your system or print it out like a hard copy.

Swiftly create a Irs Publication 786 without having to involve experts. We already have more than 3 million customers taking advantage of our unique catalogue of legal documents. Join us right now and get access to the #1 collection of web templates. Test it yourself!

How to edit Irs Publication 786: customize forms online

Check out a single service to deal with all your paperwork with ease. Find, edit, and complete your Irs Publication 786 in a single interface with the help of smart tools.

The days when people needed to print out forms or even write them by hand are long gone. These days, all it takes to find and complete any form, such as Irs Publication 786, is opening a single browser tab. Here, you can find the Irs Publication 786 form and customize it any way you need, from inserting the text straight in the document to drawing it on a digital sticky note and attaching it to the document. Discover tools that will simplify your paperwork without extra effort.

Just click the Get form button to prepare your Irs Publication 786 paperwork quickly and start editing it instantly. In the editing mode, you can easily complete the template with your information for submission. Just click on the field you need to alter and enter the data right away. The editor's interface does not require any specific skills to use it. When done with the edits, check the information's accuracy once more and sign the document. Click on the signature field and follow the instructions to eSign the form in a moment.

Use Additional tools to customize your form:

- Use Cross, Check, or Circle tools to pinpoint the document's data.

- Add textual content or fillable text fields with text customization tools.

- Erase, Highlight, or Blackout text blocks in the document using corresponding tools.

- Add a date, initials, or even an image to the document if necessary.

- Utilize the Sticky note tool to annotate the form.

- Use the Arrow and Line, or Draw tool to add visual elements to your document.

Preparing Irs Publication 786 paperwork will never be complicated again if you know where to search for the suitable template and prepare it quickly. Do not hesitate to try it yourself.

If the taxpayer makes no payment within ten days of the demand, the IRS can send out a notice of federal tax lien. The IRS will then send you in the mail a Notice of Federal Tax Lien after the tax lien has been filed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.