Loading

Get Ca T2032 E 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA T2032 E online

This guide provides a comprehensive overview of the CA T2032 E form, designed to assist users in accurately completing it online. By following the outlined steps, individuals can ensure they gather and input the necessary information with confidence.

Follow the steps to successfully complete the CA T2032 E form online.

- Press the ‘Get Form’ button to acquire the CA T2032 E form and display it in the editing interface.

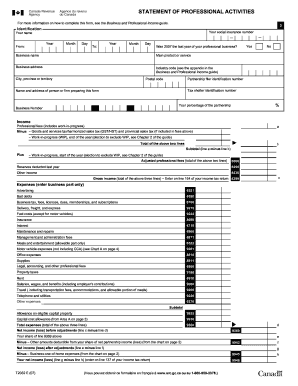

- In the identification section, enter your social insurance number and full name. Specify the year of your professional activities along with the start and end dates.

- Indicate whether 2007 was the last year of your business, then provide your business name and address, including the city, province or territory, and postal code. Make sure to fill in the industry code.

- If applicable, supply the partnership filer identification number and tax shelter identification number. Include the name and address of the person or firm preparing the form, as well as the percentage of the partnership.

- Report your income in the income section, including professional fees and any adjustments for goods and services tax. Carefully calculate your total income.

- In the expenses section, list all business-related expenses accurately, such as advertising, legal fees, and motor vehicle costs. Ensure that only the business portion of each expense is reported.

- Calculate your net income or loss by finishing the calculations based on the provided expense sections. This will help determine your overall financial position.

- In the details of other partners section, provide the required information regarding each partner’s share of net income or loss.

- If applicable, complete the calculations for capital cost allowance and ensure that the adjustments are documented correctly.

- Review all entries for accuracy. Once confirmed, save your changes, and choose to download, print, or share the completed form as necessary.

Start filling out the CA T2032 E form online today to stay organized and meet your professional requirements.

To fill out an employee withholding tax exemption certificate, start by providing your identifying details, such as your name and Tax ID number. Clearly indicate the reason for your exemption and the number of exemptions you are claiming. Platforms like US Legal Forms can offer templates and supportive tools to assist you in completing this certificate accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.