Loading

Get Az Uit-1159a 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ UIT-1159A online

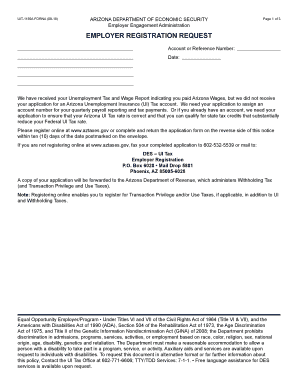

Filling out the AZ UIT-1159A form is a crucial step for employers seeking to register for an Arizona Unemployment Insurance Tax account. This guide will walk you through each section of the form, providing clear instructions to ensure a smooth online completion process.

Follow the steps to accurately complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Account or Reference Number, if applicable, followed by the Date of application.

- Provide the Legal Business Name as well as the Business Name (Trade/Doing Business As) if it differs.

- Enter your Federal Employer Identification Number (EIN) and select the Type of Ownership from the provided options.

- Complete the Business Telephone Number and Business Mailing Address, including City, State, and ZIP Code.

- Indicate whether you are liable for Federal Unemployment Tax by selecting 'Yes' or 'No', and specify the first year of liability if applicable.

- Fill in the Physical Address where work will be performed in Arizona, noting that additional sheets can be attached if there are multiple locations.

- If you have an IRS ruling that excludes you from Federal Unemployment Tax, indicate 'Yes' or 'No' and attach a copy of the ruling letter if necessary.

- Specify the First Calendar Quarter in which Arizona employees were or will be hired and paid.

- Provide details for any off-site Payroll Service, Accountant, or Bookkeeper, including Contact Person, Telephone Number, and Mailing Address.

- Describe your Business, including the type of merchandise sold or produced.

- Indicate the date when you first paid $1,500 or more in gross wages in a calendar quarter and any exceptions if applicable.

- Specify when you first reached the 20th week of employing individuals for some portion of a day, highlighting any exceptions.

- Enter at least one NAICS Code associated with your business.

- Indicate whether you previously had an Arizona Unemployment Tax Account Number and provide the necessary details if applicable.

- Question if any individuals performing services are excluded from Federal or State Unemployment/Withholding Tax.

- Answer if your business acquired all or part of an Arizona business and provide the required details.

- Indicate if there was a change in the legal form of your business operations, and provide additional details if applicable.

- Complete the identification section by entering the details of each Owner, Partner, Corporate Officer, or Managing Member.

- Finally, ensure to provide the Signature(s) of the individual(s) legally responsible for the business, along with the Date.

Start completing the AZ UIT-1159A online today to ensure your business is registered accurately.

Related links form

Tax and Wage System. "Arizona's unemployment taxable wage base will increase starting January 1, 2023. On June 30, 2021, the governor signed Senate Bill 1828. The bill increased, for unemployment insurance compensation purposes, the maximum taxable wages from $7,000 to $8,000, beginning in the calendar year 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.