Loading

Get Skipton Intermediaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Skipton Intermediaries online

This guide provides step-by-step instructions for filling out the Skipton Intermediaries form. By following these comprehensive instructions, users can successfully complete the document and confirm income for self-employed mortgage applicants.

Follow the steps to complete the Skipton Intermediaries form efficiently.

- Press the ‘Get Form’ button to access the Skipton Intermediaries document and open it in your editing tool.

- Fill in the account number where indicated at the top of the form. This is essential for identifying the applicant's account.

- Enter the client's address and name along with their postcode in the designated fields.

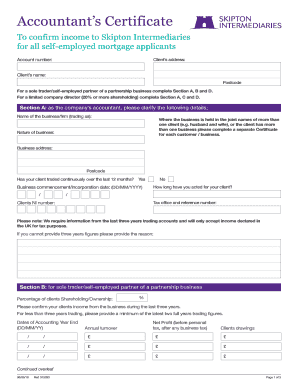

- If the applicant is a sole trader or self-employed partner, complete Sections A, B, and D. For a limited company director with 20% or more shareholding, fill out Sections A, C, and D.

- In Section A, specify the business name (trading as), nature of the business, and business address with the corresponding postcode. Confirm whether the client has traded continuously in the last 12 months and include the commencement date.

- Provide details regarding your role as the accountant including how long you have worked with the client, their National Insurance number, and tax office information.

- Provide the last three years of trading accounts. If less than three years of figures are available, explain why in the space provided.

- For sole traders, complete Section B by specifying the percentage of shareholding and confirming income from the business over the last three years. Include annual turnover, net profit, and client drawings for the respective years.

- For limited company directors, fill out Section C with the percentage of shareholding and annual financial figures for the latest three completed years. This includes annual turnover, profit activities, dividends, total assets, total liabilities, and clients' salary.

- Complete Section D by indicating whether the figures have been finalized. If they have not, provide reasoning. Additionally, comment on any substantial changes and detail other sources of income.

- Provide a professional opinion on the financial soundness of the business and whether the client can meet their obligations, including the proposed mortgage payments.

- Input your accountancy firm’s name, contact details, and qualifications. Finally, sign and date the form, ensuring all required information is accurate and complete.

- After filling out all sections, save your changes, and download, print, or share the completed form as needed.

Complete your Skipton Intermediaries document online today for efficient submission.

Performance continues to be strong, with pre-tax profits of £47.3m (2022: £39.9m); this reflects the benefits to income and margin from the rising interest rate environment, whereby SIL's net interest margin has increased to 2.37% (2022: 2.20%), whilst the ratio of administrative expenses to income remained stable at ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.