Get Nd Sfn 41216 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ND SFN 41216 online

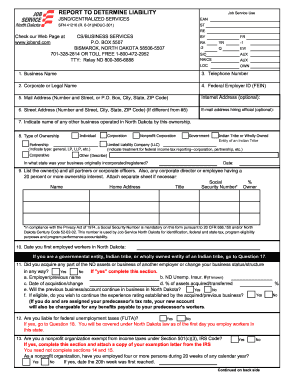

Filling out the ND SFN 41216 form is an essential step for businesses in North Dakota to report and determine their liability for unemployment taxes. This guide provides a step-by-step approach to help users complete the form accurately and efficiently, whether they are experienced in legal documents or not.

Follow the steps to successfully complete the ND SFN 41216 form online.

- Press the ‘Get Form’ button to access the ND SFN 41216 form and open it in your preferred document editor.

- Begin by entering the business name in the first field. Ensure you provide the full legal name for accurate processing.

- In the next section, input the corporate or legal name, if it differs from the business name, to clarify your entity's identity.

- Fill in the telephone number associated with the business to facilitate communication.

- Provide your Federal Employer Identification Number (FEIN) in the designated field. This is crucial for tax purposes.

- Enter your mailing address, which should include the number and street, or P.O. Box, city, state, and ZIP code.

- If applicable, fill in the street address that differs from your mailing address.

- Indicate the name of any other businesses operated under the same ownership in North Dakota.

- Choose the type of ownership from the provided options, ensuring to specify if it’s a partnership, LLC, or other types.

- List the owner(s) or partners, including their home addresses, social security numbers, titles, and ownership percentages.

- Indicate the date you first employed workers in North Dakota to establish your starting point for liability.

- Respond to the question regarding acquisition of assets or changes to business structure, providing additional information if applicable.

- Confirm if you are liable for federal unemployment taxes (FUTA), as this affects your coverage under state law.

- If you are a nonprofit organization, answer the relevant questions about your tax exemption status and employment history.

- Detail the amount of wages paid in North Dakota for each quarter, ensuring accuracy to prevent legal ramifications.

- Note if you have employed individuals during a specified timeframe, along with relevant dates.

- If you wish to become voluntarily covered, indicate your preference accordingly.

- If you have individuals you do not recognize as employees, provide explanations and the number of people involved.

- Describe your business activities in North Dakota, listing principal products or services along with their sales percentages.

- Document business locations, specifying whether they are permanent or temporary, including the city name.

- If you desire a hearing regarding your employer determination, check the appropriate box.

- Complete the contact information fields for a representative, ensuring correct details for follow-up.

- Lastly, sign and date the form before submitting it through the appropriate channels as required.

Complete your ND SFN 41216 form online today to ensure compliance and streamline your business operations.

Get form

In North Dakota, you must have worked a certain number of hours or earn enough wages during a defined period to qualify for unemployment benefits. Typically, you need to have worked for at least 20 weeks or earned a minimum amount during your base period. This ensures that only individuals who have contributed enough can access support when needed. For detailed information, you can reference the ND SFN 41216 resource.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.