Loading

Get Ny Ta-w1019-9 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY TA-W1019-9 online

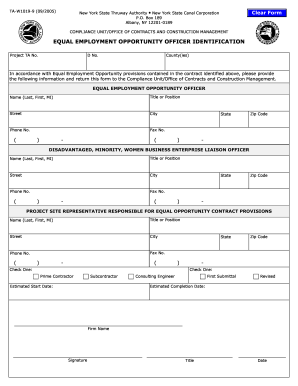

Filling out the NY TA-W1019-9 form is a crucial step in ensuring compliance with equal employment opportunity provisions. This guide offers a comprehensive breakdown of each section to assist users in completing the form accurately and efficiently.

Follow the steps to complete the NY TA-W1019-9 form online.

- Click the ‘Get Form’ button to access the NY TA-W1019-9 form. This will open the form in the editor, allowing you to begin entering the required information.

- In the 'Equal Employment Opportunity Officer Identification' section, enter the name of the officer in the format 'Last, First, MI'. Fill in their title or position, street address, city, state, and zip code.

- Provide the phone number and fax number of the Equal Employment Opportunity Officer. Ensure the numbers are correctly formatted with area codes.

- In the 'Disadvantaged, Minority, Women Business Enterprise Liaison Officer' section, repeat the process of entering the name, title, address, and contact information for the liaison officer.

- Next, fill out the 'Project Site Representative Responsible for Equal Opportunity Contract Provisions' section in the same manner. Make sure to check the appropriate box indicating whether this person is a prime contractor or subcontractor.

- Input the estimated start and completion dates for the project, ensuring these dates are clear and accurate. Also, include the firm's name where prompted.

- Lastly, have the person responsible sign and date the form at the designated space. Review all entered information to confirm its accuracy.

- Once completed, save the changes to the form. You can then download, print, or share the document as needed.

Complete your documents online now to ensure compliance and streamline your submission process.

Yes, a W 9 form can be submitted electronically, depending on the requester’s preferences. Many businesses now accept electronic copies of the W 9 for tax compliance purposes. If you are using a digital service like US Legal Forms, you'll be guided on how to securely send your W 9 to comply with your NY TA-W1019-9 requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.